Union Budget 2023: Union Finance Minister Nirmala Sitharaman presented the Union Budget 2023 to Parliament today. The Budget 2023-24 included significant capital outlays in the infrastructure and agriculture sectors, but FM Sitharaman’s main announcement was a change in tax slabs.

Sitharaman elated country’s middle class with new income tax slabs for the fiscal year 2023-24.

After many years, the tax rebate with standard deduction has increased. The salaried section will pay less tax in fiscal year 2022-23.

Read More :-UNION BUDGET 2023: ‘CENTRE TO BUILD 157 NEW NURSING COLLEGES,’ ANNOUNCES NIRMALA SITHARAMAN

Also Read :-GOLD PRICE TODAY, 1 FEBRUARY 2023: BUDGET 2023 SIDE EFFECT! GOLD, SILVER FLY AT ROCKET PACE

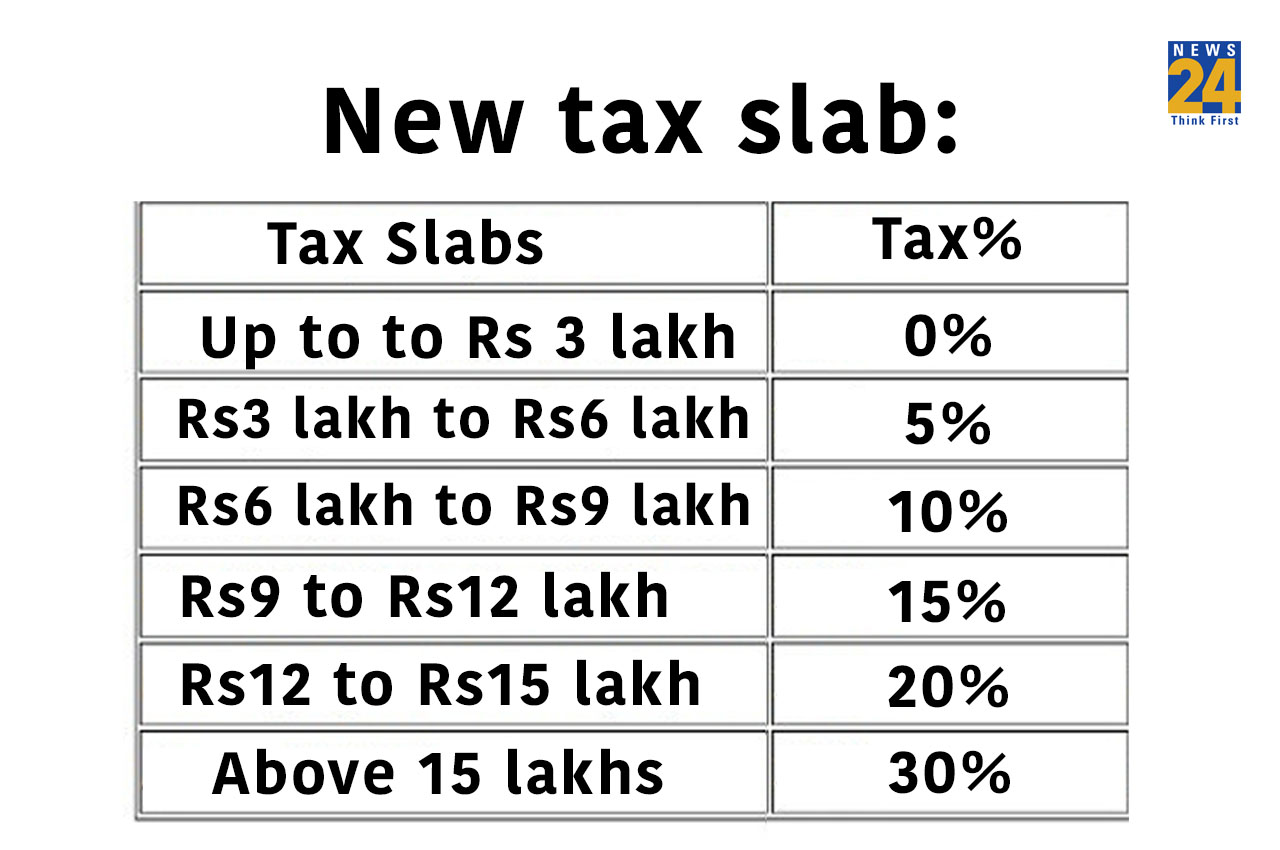

According to the Finance Minister, the income tax rebate has been extended to people with an annual income of Rs 7 lakh. This means that those earning up to Rs 7 lakh per year will have to pay no income tax. Previously, this limit was Rs 5 lakh. Here are all of the specifics about the new Income Tax regime.

The new Income Tax slab will only apply to those who choose the new tax regime. This means that those who use the old tax regime must pay taxes in accordance with the old tax structure. The new tax scheme was implemented in 2020 for those who do not make significant investments and do not seek deductions under Section 80C or other sections of the Income Tax Act. Those looking for deductions will have to stick with the old tax systems.

“I introduced a new personal income tax regime with six income slabs beginning at Rs 2.5 lakhs in 2020. I propose that the tax structure in this regime be changed by reducing the number of slabs to 5 and raising the tax exemption limit to Rs 3 Lakhs “Nirmala Sitharaman said.

Read More :-GOLD RATE UPDATE: GOLD RATE ON FIRE, CLOSE TO RS59K; DETAILS HERE

According to the new income tax rates, those earning more than Rs 3 lakh will pay no income tax. Those earning between Rs 3-6 lakh will be subject to a 5% tax. 10% will be levied on salaries ranging between Rs 6 lakh and Rs 9 lakh. 15% for those earning between Rs 9 lakh and Rs 12 lakh, 20% for those earning between Rs 12 lakh and Rs 15 lakh, and 30% for those earning more than 30%.

Also Read :-BUDGET 2023: GOOD NEWS FOR MIDDLE CLASS! MAJOR SHAKE UP IN INCOME TAX SLAB, NEW TAX REGIME TO BE ‘DEFAULT’

The government has also reduced the highest surcharge rate from 35% to 25%.

Income tax calculations: Those earning Rs 9 lakh per year will pay Rs 45000 in taxes. Those earning Rs 15 lakh will pay Rs 1.87 lakh in tax.

“The new tax rates are 0% to Rs 3 lakhs, 5% to Rs 6 lakhs, 10% to Rs 9 lakhs, 15% to Rs 12 lakhs, 20% to Rs 15 lakhs, and 30% to Rs 30 lakhs,” said Union Finance Minister Nirmala Sitharaman.

Read More :- Latest Business News