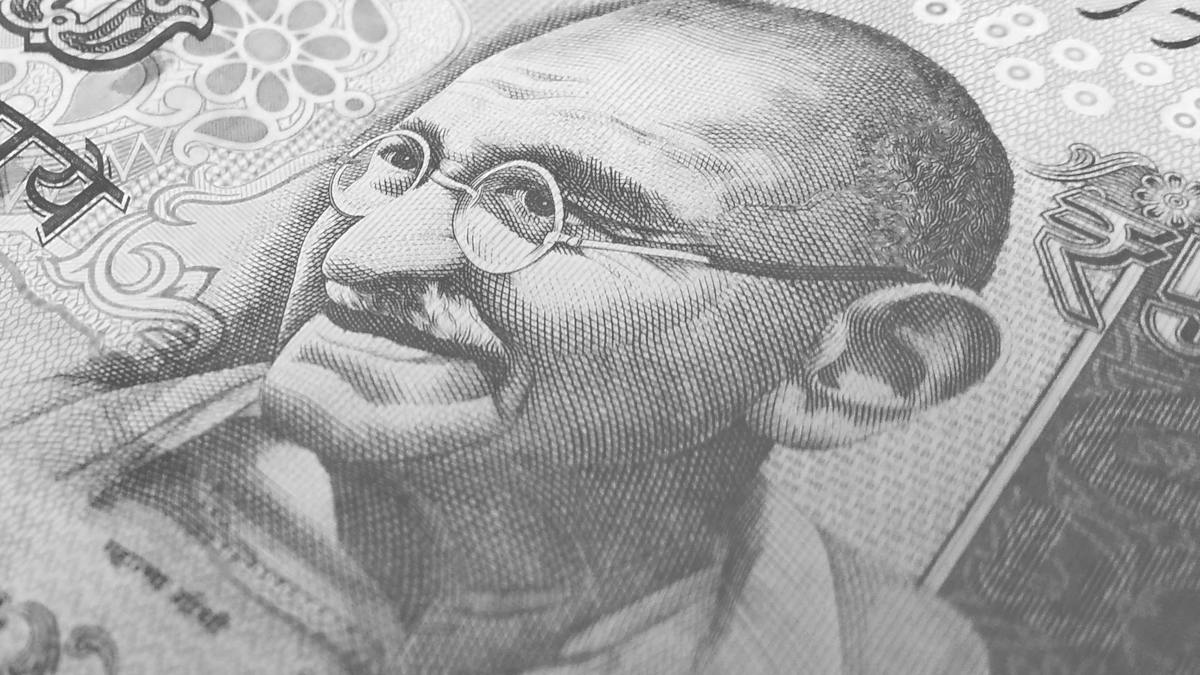

The Pension Fund Regulatory and Development Authority (PFRDA) has issued new withdrawal rules for the National Pension System, effective February 1, 2024. According to PFRDA, under the new NPS guidelines, no one can withdraw more than 25% of the money from their NPS account. This amount will include funds from both the company and the employee.

Also Read: 77-Year-Old Specially Abled Woman Crawls 2km In Karnataka Seeking Unpaid Pension

NPS users are only allowed to make partial withdrawals three times during their investing period. Customers who make partial withdrawals should stay invested for at least three years. This means that 25% of the total sum can be taken at any moment after three years. This money can be taken for a variety of objectives, including children’s education, marriage, home construction, and medical situations.

When Can A Person Withdraw Money?

- If the consumer wants to spend the money on their children’s further education, they can withdraw it.

- This sum may also be withheld for the marriage of children.

- You can also withdraw funds for property purchases, loan repayment, and other purposes.

- This money may also be withdrawn for serious illness, treatment, or other medical expenses.

- Even in the event of an emergency, up to 25% of the funds can be withdrawn.

- This sum can also be utilized to launch any type of business or start-up.

Other Conditions Regarding Partial Withdrawl

- To make a partial withdrawal from an NPS account, the subscriber must have been a member for three years from account opening.

- Partial withdrawals of more than 25% are not permitted.

- Account holders can only make partial withdrawals three times.

How To Withdraw Money?

If the amount to be withdrawn under NPS is 25% or less, a representative of the Central Recordkeeping Agency (CRA) may make a withdrawal request through the government nodal officer. The cause for withdrawal, as well as other information, must be provided. If the subscriber is unable to make the request, a family member or nominee may do so on his behalf.

It is worth noting that, according to the Pension Fund Regulatory and Development Authority (PFRDA), after the age of 60 (retirement), it is possible to withdraw 60% of the whole maturity amount in a lump sum from NPS, which is tax-free. The remaining 40% of the maturity amount must be invested in an annuity plan, from which one can receive a pension. The cash invested in an annuity is tax-free, but the pension amount received as a return is not tax-exempt.

This means that the pension received as return is added to the investor’s annual income, and the taxpayer must pay tax based on the tax slab. After retirement, if the total corpus is equal to or less than Rs 5 lakh, NPS subscribers may withdraw the entire amount

Also Read: Horrifying! A Woman Murdered Her Look Alike To Escape Her Strict Iraqi Family