50th GST Council Meeting: The 50th Goods and Services Tax (GST) Council on Tuesday announced to levy of a 28 percent tax on the turnover of online gaming platforms, horse racing, and casinos at full value.

The GST Council agreed upon that there should be no distinction between ‘game of skill and game of chance.’

Read More: 50th GST Council agrees to levy 22% cess for MUVs

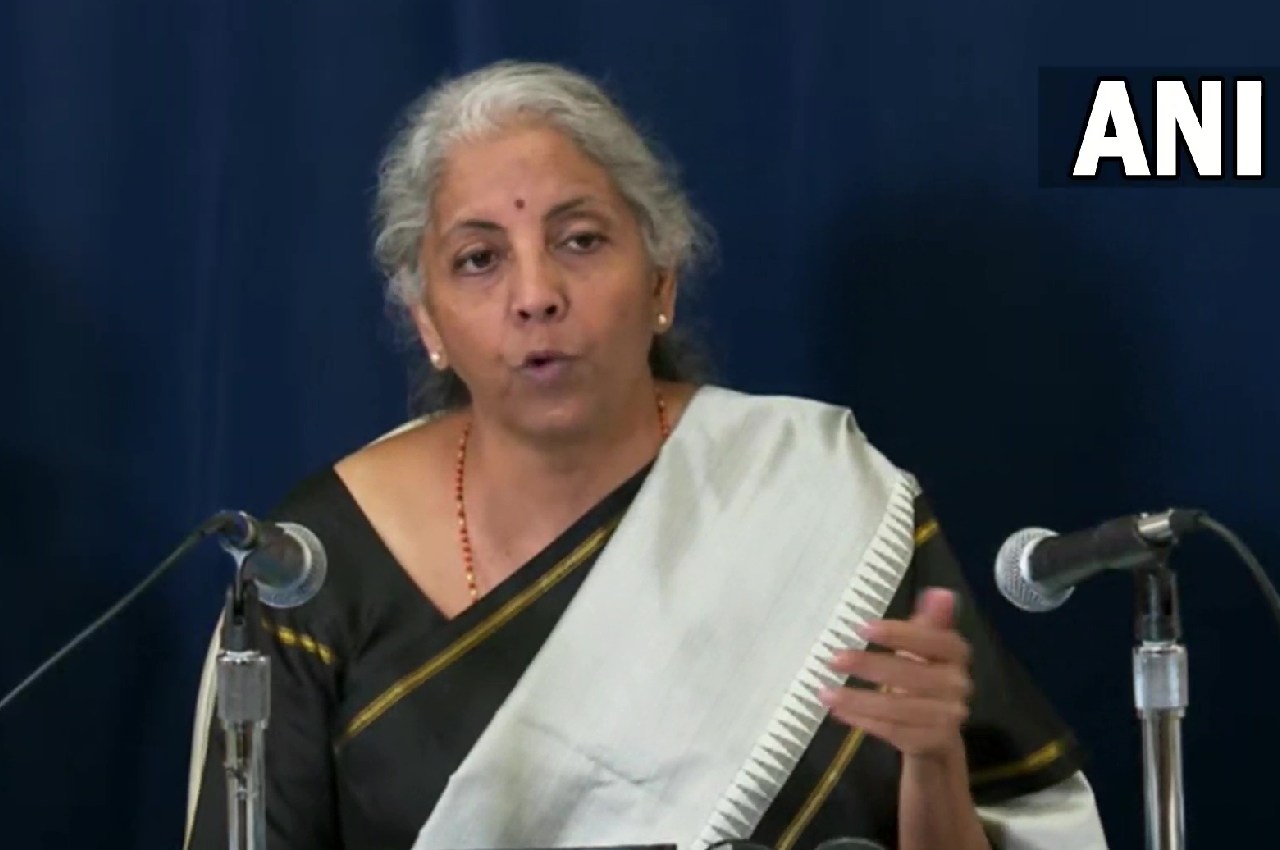

The panel was headed by the Union Finance Minister Nirmala Sitharaman, having representatives from all the states and UTs, who decided to impose 28 per cent GST based on the recommendation of the Group of Ministers (GOM) who looked into taxing casinos, horse racing, and online gaming.

A Group of Ministers (GoM) was constituted to look into the issues related to taxation on casinos, horse racing and online gaming. The GoM submitted its first report in June 2022 and it was placed before the GST Council in its 47th GST Council meeting wherein, it was decided that the GoM may relook into all the issues once again. The GoM submitted its report and it was placed before the 50th GST Council meeting.

The GoM, in its second report, has recommended that since no consensus could be reached on whether the activities of online gaming, horse racing and casinos should be taxed at 28% on the full-face value of bets placed or on the GGR, the GST Council may decide.

The GST Council has deliberated on the issues and has recommended the following:

- Suitable amendments to be made to the law to include online gaming and horse racing in Schedule III as taxable actionable claims.

- All three namely Casino, Horse Racing and Online gaming to be taxed at the uniform rate of 28%.

- Tax will be applicable on the face value of the chips purchased in the case of casinos, on the full value of the bets placed with bookmaker/totalisator in the case of Horse Racing and on the full value of the bets placed in case of the Online Gaming.

Amid the discussion, the GoM (group of ministers) faced confusion on whether to levy 28 percent GST on the face value of bets, gross gaming revenue, or platform fees.

However, FM Sithramn said that the GST would be levied on the entire value.

“GST Council has decided that online gaming, casinos and horse racing will be taxed at 28 per cent at the entry point on the full face value of bets,” said Nirmala Sitharaman, Finance Minister, while addressing the media.

Finance Minister also underlined that changes will be made in the GST law in order to state that these three supplies are not actionable claims, like that of lottery and betting.

Meanwhile, Maharashtra forest cultural and fisheries minister, Sudhir Mungantiwar, said, “The council has decided to do away with the distinction of game of skill and chance in case of online gaming.”

He said that on the full face value of the bets will attract a 28 per cent tax.

“The council has also approved setting up of appellate tribunals for the same,” Mungantiwar further added.

(Written by – Mahek Nigam

Edited by – Prateek Gautam)