Good news for taxpayers: It is good news for taxpayers. The government is considering raising the tax slab limit to Rs 5 lakh. At present, there is no income tax up to Rs 2.5 lakh per year. So, if your annual income is less than Rs 5 lakh, you will not be required to pay income tax. It could be announced in the next budget. This will be the last full budget of Modi’s second term. General elections will be held throughout the country in 2024. So it is obvious and expected that the Modi government can provide tax relief in its final full budget. The budget for fiscal year 2023–24 will be presented on February 1, 2023. It is also noted that the last change in the personal tax exemption limit occurred in 2014. When presenting the first budget of the Modi government’s first term, then-Finance Minister Arun Jaitley announced an increase from Rs 2 lakh to Rs 2.5 lakh.

GOLD, SILVER PRICE UPDATE: BUY GOLD FOR LESS THAN RS 2,300 PER 10 GRAM! DON’T MISS THE CHANCE

According to a Business Standard report, the government is considering raising the personal tax exemption limit under the two-year-old tax regime. It is possible to increase it from Rs 2.5 lakh to Rs 5 lakh. Officials claim that this will provide relief to taxpayers and allow them to invest more money. The alternative tax regime was announced by the government two years ago. However, it was not given much weight. This is why the government is preparing to change it in order to make it more popular.

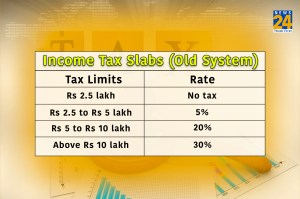

Difference between the old and new tax structures

Sections 80C and 80D of the old tax code allowed taxpayers to save money. However, many of these exemptions have been eliminated in the new system. This is why only about 10 to 12 taxpayers have chosen the alternative tax regime. This is tax-free up to Rs 2.5 lakh.

The expected revisions in tax slab rates in Budget 2023 are as follows:

- The tax rate on income over Rs 20 lakh should be reduced from 30% to 25%

- The tax rate on income between Rs 10 lakh and Rs 20 lakh should be reduced from 30% to 20%

- The slab rate for income in the Rs 10 lakh to Rs 20 lakh bracket should be reduced from 30% to 20% in the new tax regime.

- The tax rate on income above Rs 20 lakh should be reduced from 30% to 25% under the new regime.

According to sources, suggestions for introducing a new tax system have been sought from the concerned departments. According to an official, the tax budget discussion will begin shortly, and the possibility of reviewing the current tax regime will be discussed. There has been some preliminary analysis, and there may be more confusion on this. Personal income tax changes can be considered in both the new and old systems. Tax rates were kept low, but many types of exemptions were eliminated.

Read More :- Latest Business News