Oxfam Report richest five: In a shocking revelation coinciding with the World Economic Forum in Davos, Oxfam’s latest report brings to light the fact that the combined fortunes of the world’s five wealthiest men surged from $405 billion in 2020 to a staggering $869 billion last year. This sharp increase in wealth occurs against the backdrop of nearly five billion people globally experiencing a decline in their financial status.

The Elite vs. The Masses

The report, unveiled as global elites gather in the Swiss Alpine resort, underscores a troubling trend of increasing wealth concentration amidst widespread economic challenges, including the aftermath of the Covid-19 pandemic. Oxfam’s annual inequality report emphasizes the growing divide, revealing that billionaires collectively became $3.3 billion richer since 2020.

Read More: Maldives Asks India To Withdraw Military Personnel Amid Existing Tensions, Sets March 15 Deadline

Oxfam Report richest five – Influence on Tax Policies

Oxfam’s critique extends beyond wealth accumulation, pointing to the influential role played by the ultra-rich in shaping tax policies to their advantage. The charity accuses corporations of exacerbating inequality by exploiting workers, evading taxes, and privatizing state functions. This “sustained and highly effective war on taxation” has led to a significant reduction in corporate taxes in OECD countries, dropping from 48 percent in 1980 to just 23.1 percent in 2022.

Oxfam Report richest five – Power and Privilege

The findings indicate a troubling concentration of power, with corporations influencing everything from wages to food prices and access to medicines. Oxfam’s report states, “Around the world, members of the private sector have relentlessly pushed for lower rates, more loopholes, less transparency, and other measures aimed at enabling companies to contribute as little as possible to public coffers.”

Proposed Solutions

To address this imbalance, Oxfam advocates for the implementation of a wealth tax on millionaires and billionaires, potentially generating $1.8 trillion annually. Additionally, the charity calls for capping CEO pay and dismantling private monopolies.

Contrasting Fortunes

The report estimates that 148 top corporations made $1.8 trillion in profits, a 52 percent increase on the three-year average. This allowed substantial payouts to shareholders, even as millions of workers faced a cost-of-living crisis due to inflation leading to wage cuts in real terms.

Impact of Inflation and Wage Stagnation

The report sheds light on the disproportionate impact of inflation and wage stagnation, with nearly 800 million workers worldwide experiencing a decline in real wages, equating to an average loss of 25 days of annual income per worker. Despite this, the top 148 corporations have seen a 52 percent increase in profits over a three-year average, leading to substantial payouts to shareholders.

Oxfam Report richest five – Stakeholder Capitalism vs. Shareholder Capitalism

Oxfam’s analysis reveals a stark contrast to the ideals of “stakeholder capitalism” promoted by the World Economic Forum, advocating for corporations to fulfill societal aspirations alongside profit maximization. However, Oxfam’s Head of Inequality Policy, Max Lawson, argues that the current system of shareholder capitalism is a driving force behind escalating inequality.

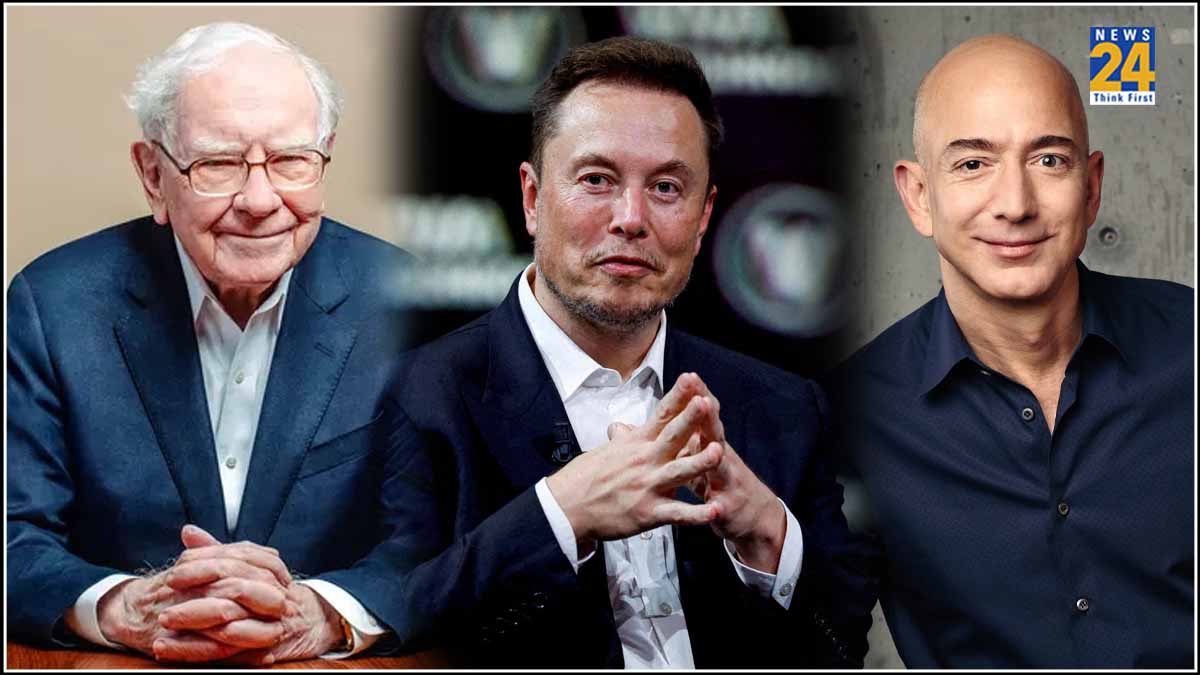

The Wealthy Elite’s Gains

The report highlights the significant wealth gains of individuals such as Tesla CEO Elon Musk, LVMH chief Bernard Arnault, Amazon’s Jeff Bezos, Oracle co-founder Larry Ellison, and investor Warren Buffett. In contrast, a mere 0.4% of the world’s 1,600 largest corporations have committed to paying workers a living wage and supporting it throughout their value chains.

Read More: Horrifying: Woman Accused Of Killing Boyfriend’s Child By Feeding Her Screws, Batteries

Oxfam’s Call to Action

As the Davos meetings unfold, Oxfam’s call for governments to rein in corporate power and address the widening wealth gap resonates more than ever. The charity’s proposals for breaking up monopolies, taxing excess profits and wealth, and exploring alternatives to shareholder control, like employee ownership, present a roadmap for tackling the deep-rooted inequalities that plague the global economy.