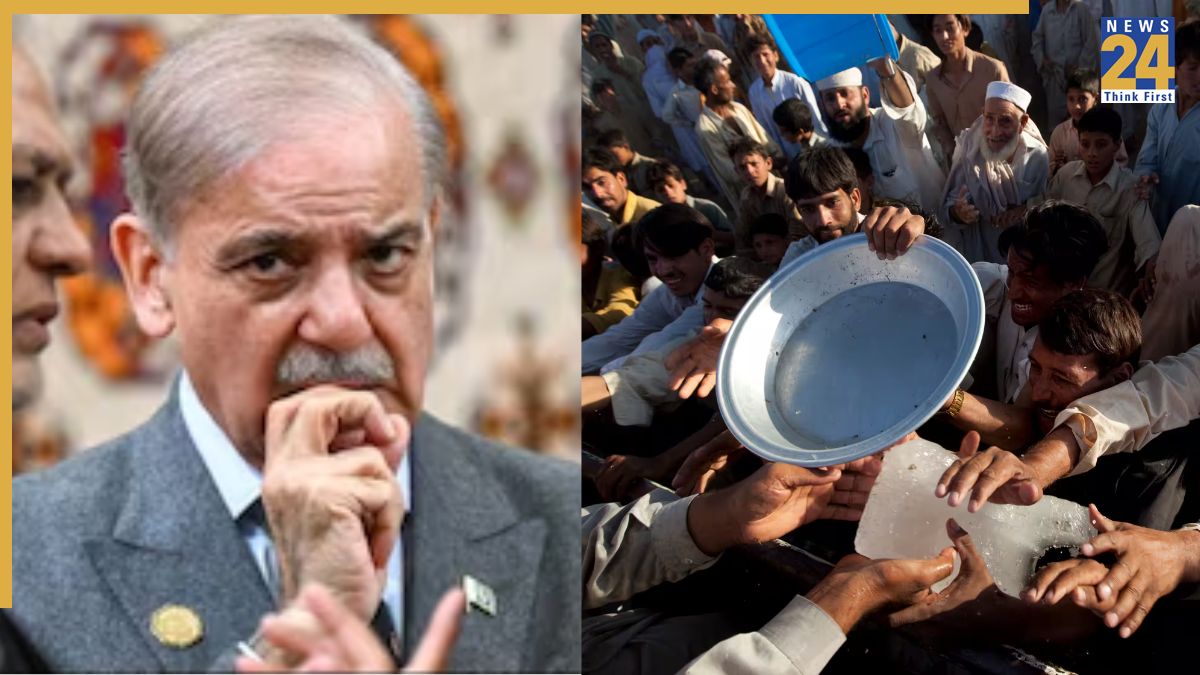

IMF Bailout: In a major setback for Pakistan, the International Monetary Fund (IMF) has imposed 11 new conditions under its $7 billion bailout programme. To receive financial assistance and avoid bankruptcy, Pakistan must now comply with a total of 64 conditions within an 18-month period. According to the IMF, the latest move is aimed at cracking down on corruption.

Why the new conditions on Pakistan?

The decision was taken after the IMF expressed serious concerns about how Pakistan is managing its economy and implementing reforms. Even though the IMF approved a fresh release of about $1.2 billion under its bailout programmes, it warned that Pakistan faces risks due to policy failures, weak institutions, and long-standing structural problems.

Immediate disbursements of about $1.2 billion

In a report, the Fund stated that it has approved an immediate disbursement of approximately $1 billion under Pakistan’s Extended Fund Facility (EFF) and around $200 million under the Resilience and Sustainability Facility (RSF).

What are the new conditions from IMF?

The new conditions are not limited to budget cuts or tax changes. They directly focus on fixing long-standing problems in governance, corruption, and the control of key economic sectors by powerful elites. This strict approach follows the IMF’s recent Governance and Corruption Diagnostic Assessment, which pointed out serious weaknesses in Pakistan’s legal and administrative systems.

To improve the integrity of its institutions, Pakistan must publish action plans by October 2026 to address corruption risks in 10 high-risk departments identified through internal reviews.

These steps will be coordinated by the National Accountability Bureau (NAB). Provincial anti-corruption agencies will also be strengthened and given access to financial intelligence, along with the authority to carry out independent investigations.

By December 2025, Pakistan must finalise a detailed reform plan for the Federal Board of Revenue (FBR), including clear performance targets. It must also fully implement reforms in at least three key areas.

The IMF has warned that if revenue targets are not met by December 2025, the government will have to bring in a mini-budget. This could include higher excise taxes on items such as fertilisers, pesticides, and expensive sugary products.