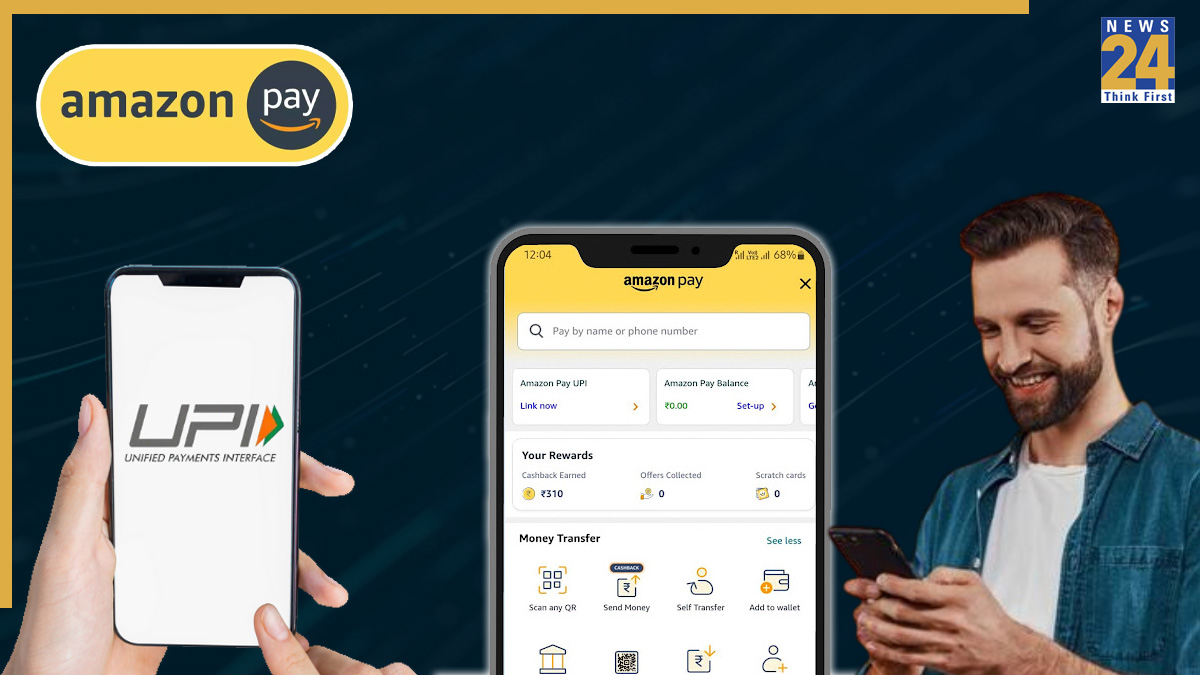

Tired of entering your UPI PIN every time? Here’s some good news for all the digital users. Amazon Pay is making UPI payments much easier. The company has launched the UPI Biometric Authentication feature in India. This means you can now make payments using your face or fingerprint on Amazon Pay without entering the four-digit PIN. This feature will be especially useful for people who like to make quick online payments or want to avoid the hassle of typing a PIN repeatedly. With this launch, Amazon Pay has become the first payment platform in India to offer biometric UPI payments.

Now, if you use Amazon Pay for UPI payments, you don’t need to enter your PIN. Instead, you can pay using biometric authentication, such as your face or fingerprint.

For security reasons, this feature is limited to transactions up to 5,000 rupees. This means that for payments below 5,000 rupees, you won’t need to enter a PIN. However, if the payment exceeds 5,000 rupees even by one rupee, you will still need to enter your four-digit PIN. Amazon revealed that during initial testing, around 90% of users chose the biometric option over the PIN. This shows that the feature is likely to become very popular in the coming days.

What are benefits of using this feature?

The main purpose of UPI Biometric Authentication is to reduce “transaction friction”, which means it removes small interruptions and hassles during payments. This feature works across all major modes of payment on Amazon Pay, including Send Money, Scan & Pay, and online merchant payments. From a security perspective, this feature is very safe. Your biometric data cannot be shared with anyone else and cannot be stolen. Additionally, the feature makes it easier to make payments using just one hand, which is convenient for many users.

Who can use this feature?

Currently, the feature is available only for Android users on smartphones that support fingerprint or face unlock. Amazon has said that it will soon roll out the feature for iOS users as well. With PIN-free UPI, payments will not only save time but also offer a smoother and more secure experience. In the coming days, this method could become the new standard for digital payments in India.