New Delhi: A video showcasing a groundbreaking innovation has taken social media by storm, revealing how individuals can now withdraw cash from ATMs using the Unified Payments Interface (UPI). Although this technology is not yet publicly accessible, it is being introduced in phases, promising a transformative shift in traditional banking.

The UPI’s remarkable growth

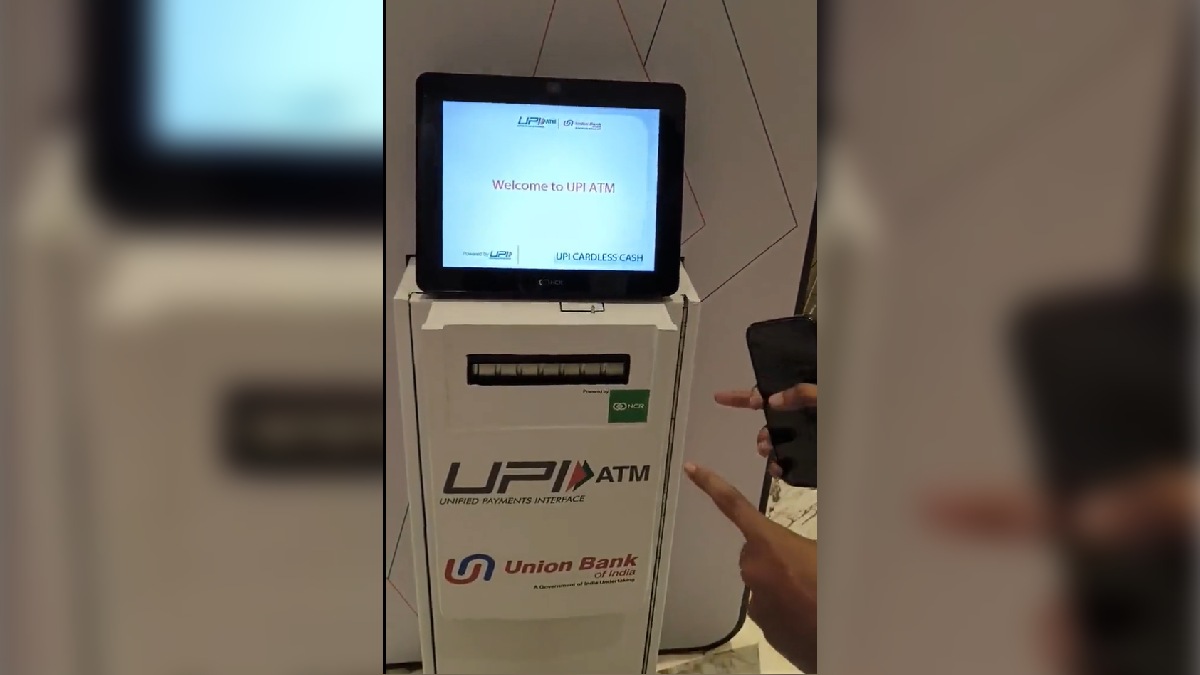

The Unified Payments Interface (UPI) has rapidly gained prominence as the nation’s fastest-growing payment method, enabling instantaneous money transfers via mobile devices. The ongoing Global Fintech Fest in Mumbai recently unveiled a groundbreaking UPI ATM, a first-of-its-kind in India. This innovative feature eliminates the need for physical ATM cards, prompting widespread enthusiasm among internet users who hail it as a “game changer.”

Demonstrating the future

Union Minister Piyush Goyal shared a video on X, featuring Ravisutanjani, a prominent FinTech influencer, showcasing the cash withdrawal process from an ATM using UPI. In the video, Mr. Ravisutanjani selects the UPI cardless cash option, enters the desired withdrawal amount, and scans the resulting QR code using the BHIM app. With the input of his UPI PIN, he swiftly collects the cash.

Future of FinTech unveiled

Mr. Goyal heralded the UPI ATM as “the future of fintech.” This unique ATM has been developed by the National Payments Corporation of India (NPCI) and is powered by NCR Corporation.

Expanding accessibility

While this UPI ATM will function as a standard ATM, it may incur charges beyond the permitted free usage limit. Initially available on the BHIM UPI app, it will soon extend its accessibility to other popular apps like Google Pay, PhonePe, and Paytm.

UPI ATM: The future of fintech is here! 💪🇮🇳 pic.twitter.com/el9ioH3PNP

— Piyush Goyal (@PiyushGoyal) September 7, 2023

Phased rollout, user reactions

While this technology is currently undergoing phased implementation, its potential impact has already captured the public’s imagination. Users have expressed their enthusiasm for this innovation, highlighting its potential benefits, particularly for those who understand UPI but not debit cards, making cash withdrawals more accessible.

UPI’s astounding milestone

Notably, UPI recently achieved a remarkable milestone by surpassing 10 billion transactions in a single month, reaching a historic peak of 10.58 billion transactions in August. Officials from the National Payments Corporation of India envision the country’s potential to achieve an astounding 100 billion Unified Payments Interface (UPI) transactions per month, highlighting the growing significance of digital payments in India’s financial landscape.