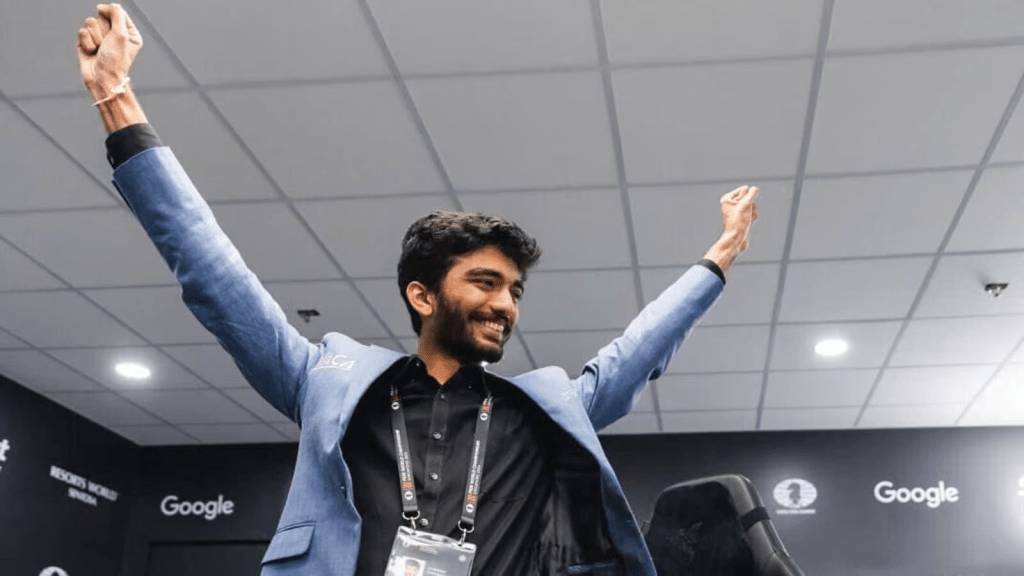

In an extraordinary feat, Indian Grandmaster D Gukesh became the youngest World Chess Champion at the age of 18 on Thursday, defeating reigning title-holder Ding Liren of China in the thrilling 14th and final game of a dramatic showdown but he has not only made waves in the world of chess by winning the prestigious title but has also made headlines for the staggering tax amount he needs to pay on his earnings. Recently, after winning a substantial ₹11 crore prize money, Gukesh is facing an income tax bill of ₹4.67 crore, which has sparked widespread discussion. Let’s break down how this high tax figure came into play.

D Gukesh’s win at the World Chess Championship has earned him a grand prize of ₹11 crore, a remarkable feat for such a young player. This victory has cemented his status as one of the top players in the chess world. However, with great success comes great responsibility particularly in the form of taxes.

The Tax Calculation

In India, income tax rates on prize winnings are relatively high, especially when the amount crosses a certain threshold. The tax is calculated based on the income slab, and Gukesh’s ₹11 crore falls into the highest category, attracting a significant tax percentage. According to reports, D Gukesh will be required to pay ₹4.67 crore as tax, which is approximately 42.5% of his prize money. This is a substantial amount, highlighting the high taxation on prize money in India, particularly in cases of large winnings.

Also Read: Gukesh Creates History, Becomes Youngest World Chess Champion

Reactions From Netizens

Following the news of Gukesh’s tax bill, social media platforms have been abuzz with reactions. Many netizens have expressed surprise at the large tax amount, with some criticizing the high tax rates on prize money. On the other hand, several users have defended the taxation system, arguing that it is a necessary part of maintaining the country’s economy. Gukesh himself has not commented on the tax matter, but his win remains a topic of national pride.