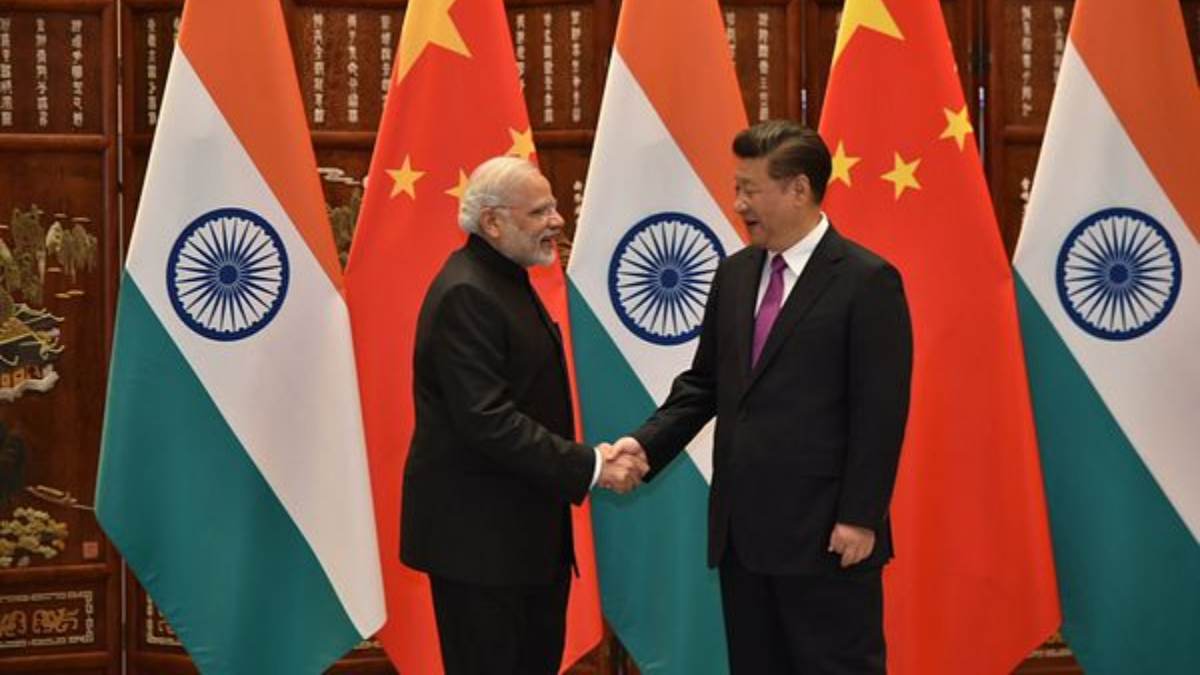

The disengagement process in Demchok and Depsang in Ladakh along the India – China Line of Actual Control or the LAC may make a watershed moment in the relationships between the two countries. The announcement came just before Prime Minister Narendra Modi met Chinese President Xi Jinping on the sidelines of the BRICS Head of the Governments meeting in the Russian city of Kazan. Besides the political significance and the geopolitical ramifications, it may have far-reaching business and economic implications as well.

China In Economic Crisis

The thaw in the relationships between the two countries has come at a time when Beijing has suffered a series of economic setbacks with its growth rate slowing down, unemployment going up, the real estate market going bust, and exports falling amid surplus production and increased capabilities.

China In Tariff War

China is caught in a tariff war with the US at a time when it is facing stiff resistance from the European Union member states. Though the domestic market has increased many folds and demand has skyrocketed, the Chinese economy has increased its production capabilities so much that it cannot absorb all it produces.

Will China Make India Manufacturing Hub?

Experts believe New Delhi and Beijing should use the improved bilateral relationship as an opportunity to develop India as a manufacturing hub to export products across the world. Analysts also believe China should make fresh investments and establish manufacturing plants in the country instead of dumping its cheap products here.

India-China Trade Deficit

According to the UN COMMTRADE data, Chinese exports to India during 2023 were $99.59 billion while India exported goods worth $16.23 billion to China, resulting in a staggering trade gap of $83.36 billion.

Electric Vehicle

Considering the Chinese capability in the Electric Vehicles sector and growing EV space in India, the experts believe China should make India a manufacturing hub for this genre of cars. It may be a win-win situation for both countries.

Chinese Mobile Phone

Similarly, considering the export of mobile phone handsets and related equipment, Chinese companies can open manufacturing facilities in India. It can be a long list.

China In Futuristic Business

Experts believe China should encourage its firms, particularly the state-controlled ones to invest in India in a big way also because Beijing has decided to focus on new and futuristic businesses like Artificial Intelligence, Machine Learning, renewable energy, green energy, space science, telecom, robotics, and internet-based businesses. They want to come out of the traditional businesses.

Chinese Investment In India

Despite political tension and border disputes, Chinese investment in India has been growing for a long time and it has increased many folds since 2014. Start-ups are the favourite of Chinese investors, who want to be a major players in India’s start-up ecosystem. It can be gauged by the fact that more than half of India’s 30 unicorns, with a valuation of over $1 billion each, have Chinese investors.

Besides, Chinese companies have also invested in technology, including electric batteries and home appliances. Medicine is one more area where Chinese firms have invested as India has emerged as one of the top destinations of medicine manufacturing. Chinese companies like Alibaba have invested in a big way in the E-commerce sector considering the massive population and a vibrant and expanding middle class with desire and money to spend. Media and social media, fintech and logistics are the other domains of interest for Chinese companies, including state-controlled giants

How Much Has China Invested In India?

According to the Ministry of Commerce of China, the cumulative Chinese investment to India by the end of 2021 amounted to USD 5.403 billion.

If reports are to be believed, Chinese funding in India increased five times between 2014-17. It soared from $1.6 billion in 2014 to $ 8 billion, during the first 3 years of the Narendra Modi government.

Besides, it has also been reported that the Chinese financial support in Indian businesses and start-ups soared by 12 times between 2016 and 2019.

Will India Ease Restrictions On Chinese Investment?

However, it is too early to conclude that there will be too much inflow of Chinese investment into India considering the restrictions New Delhi has put on the firms of the Asian giant.

In what may be termed as a rebuttal, Finance Minister Nirmala Sitharamas has said that India cannot blindly receive Foreign Direct Investment (FDI) because it wants money, as it cannot be forgetful or unmindful of where it is coming from.

Speaking at the US’s Wharton Business School, she made it clear that New Delhi wants business and investment, but it also needs some safeguards. Nirmala Sitharaman said bluntly, “India is located in a neighbourhood which is very, very sensitive.”

If media reports are to be believed, the Indian government may take the first step in this direction by easing curbs on Chinese investments.

Economic Survey Bats For Chinese Investment

The speculation started doing the rounds after the Economic Survey 2024 suggested that the best way for India to get deeper into global supply chains was through Chinese FDI.

It was said in the Economic Survey 2024 that Chinese investments would help India benefit from the China-plus-one approach. According to the formula adopted by Europe, Chinese companies should invest in the country and then export the products to the world markets rather than importing from China and then re-exporting them with minimal value addition.

What is the way forward, what will happen next? Much water will flow down the Yangtze River before we get the answer to this question.