Link PAN card-Aadhar card: The deadline for linking Aadhar card to Pan card is approaching very fast. February is already coming to an end and you have only one month period to link your Aadhar card to PAN card. If you have a PAN card but have not yet linked it to Aadhaar, this article is important news for you. If the cardholder does not link the Permanent Account Number (PAN) to the Aadhaar card, the card will become inactive after March 2023. Central Board of Direct Taxes (CBDT) has made mandatory to link PAN with Aadhar card. Your PAN card will be closed, and your problems will begin. (Link PAN card-Aadhar card)

The Central Board of Direct Taxes (CBDT) imposed a Rs 1000 late penalty for linking Aadhaar with PAN after June 30. No one will be able to link their PAN to their Aadhaar unless they pay the late fee. PAN and Aadhaar numbers can be linked until March 31, 2023.

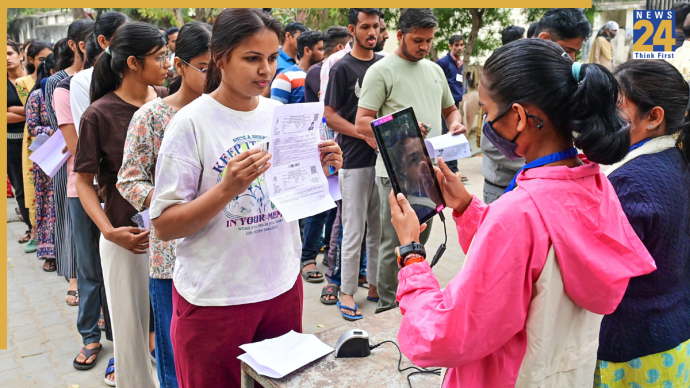

Read More :- NEET UG 2023: REGISTRATION FOR THIS EXAM TO START SOON, KNOW DETAILS HERE

PAN-Aadhar card linkage: Link your Aadhaar and PAN cards in this manner.

- Navigate to the official Income Tax website.

- Navigate to the Quick Links section and select Link Aadhaar.

- In a new window, enter your Aadhaar number, PAN, and mobile number.

- Select the ‘I validate my Aadhaar details’ option.

- You will be sent an OTP to your registered phone number. Fill it out and press the ‘Validate’ button.

- Your PAN will be linked to your Aadhaar after you pay the fine.

Rs10,000 fine to be imposed

If cardholders do not link, they will only be able to use the PAN card until it expires in 2023. PAN card holders will no longer be able to open bank accounts, mutual funds, or stock accounts after this date. Furthermore, if you use a locked PAN card as a document anywhere, you may be subject to additional charges. Section 272B of the Income Tax Act 1961 also allows for a fine of up to Rs 10,000.

‘As per the Income Tax Act, 1961, the last date for linking PAN with Aadhaar is 31.3.2023 for all PAN holders who are not exempted,’ Income Tax India tweeted. PAN will become inactive if it is not linked to Aadhaar. ‘Don’t put it off, link today!’

Read More :- Latest Education News