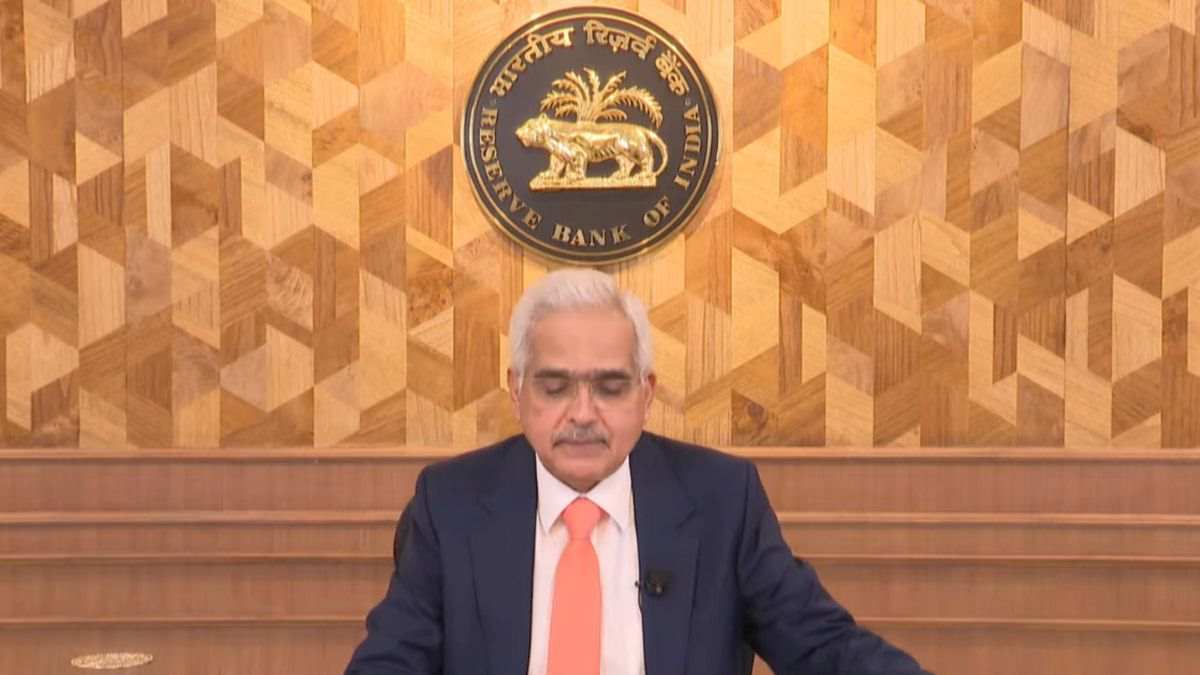

Reserve Bank of India (RBI) held its 51st Monetary Policy Committee (MPC) meeting on 7, 8 and 9 October. Notably, this was the first RBI MPC meeting after three new external members appointed by the government on the panel last week. The major decision of the MPC was to keep the Repo Rate unchanged at 6.5%. This is the tenth straight time when the key rate has been kept unchanged. The Decision was announced by RBI Governor Shaktikanta Das in monetary policy statement on Wednesday.

Also Read: RBI Keeps Lending Rates Unchanged For The Tenth Straight Time

Key Takeaways Of The RBI MPC Meeting

- MPC decided by a majority of 5 out of 6 members to keep the policy repo rate unchanged at 6.50%.

- The standing deposit facility (SDF) rate remains at 6.25%.

- The marginal standing facility (MSF) rate and the Bank Rate kept unchanged at 6.75%.

- RBI has changed its monetary policy stance of ‘withdrawal of accommodation’ to ‘neutral’.

- Real gross domestic product (GDP) grew by 6.7% in Q1 of 2024-25.

- The share of investment in GDP reached its highest since FY 2012-13.

- RBI projected real GDP to grow at 7.2% rate in FY 2024-25.

- Consumer Price Index aka Retail inflation for FY 2024-25 is projected at 4.5%.

- MPC noted that Indian Rupee continued to be the least volatile currency among the emerging market economies.

What RBI Governor Said?

“Today, the Indian economy presents a picture of stability and strength,” said RBI Governor Shaktikanta Das in Monetary Policy statement. He emphasized that the balance between inflation and growth in the country is well-poised.

“India’s growth story remains intact. Inflation is on a declining path, although we still have a distance to cover. The external sector demonstrates the strength of the economy,” said Das. Das noted that the financial sector of the country remains sound and resilient. He said that global investor optimism in India’s prospects is perhaps at its highest ever. “We stand unambiguously committed to ensure durable alignment of inflation with the target, while supporting growth,” Das concluded.

Also Read: What Is Monetary Policy And How Repo Rate Impacts Common People?