New Delhi: In recent times, it has become sort of an easy task to file Income Tax Returns (ITR). With one tap on any device, anybody can file an ITR form from the comfort of their home.

To make the whole process more comforting, the Income Tax department has introduced a pre-filled ITR form. Availing the vast pool of available data in its database, the tax department automatically fills in various details, such as salary income, interest income along with tax payments.

With the help of such a step, the time taken to fill out the form lessens and makes the process a lot more user-friendly for taxpaying individuals in India.

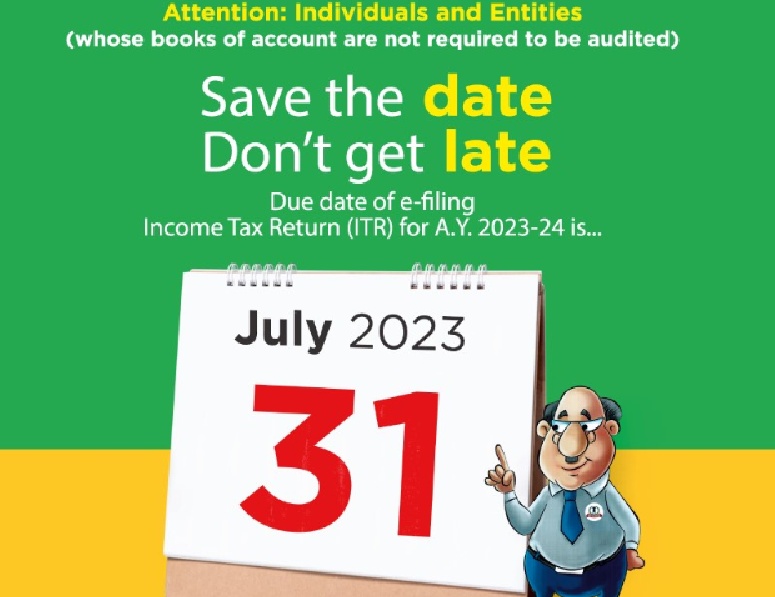

Last date of ITR filing

It is important to note that the last date for ITR filing of the Financial Year 2022-23 (AY 2023-24) was July 31, 2023. The scheduled date marks the high point of the four-month window, in which the government allows taxpayers to accumulate their income details and file their ITR without having to pay any fee.

In case the deadline is missed

First of all, it should be kept in mind that an ITR should always be filed under the given stipulated time. However, if a taxpayer has missed the deadline, it might incur a penalty of Rs 5,000 under section 234F.

Moreover, a taxpayer who is not required to file an ITR under Section 139 of the Income Tax Act due to their financial constraints, will not be subjected to a late fee as per Section 234.

Adding further, for those individuals earning less than Rs 5 lakh, the penalty will be Rs 1,000.

Scope of filing an ITR beyond the deadline

Even if an individual has missed the deadline, he/she can submit what is known as a belated return. In case of missed deadline, the belated return can be filed up to December 31, 2023.

The late filing fee of Rs 5,000 or 1,000 as relevant will be levied on filing the belated ITR, which may attract interest on the tax amount.

The option to file an updated return after the belated return’s due date has expired is given under sub-section (8A) of Section 139.