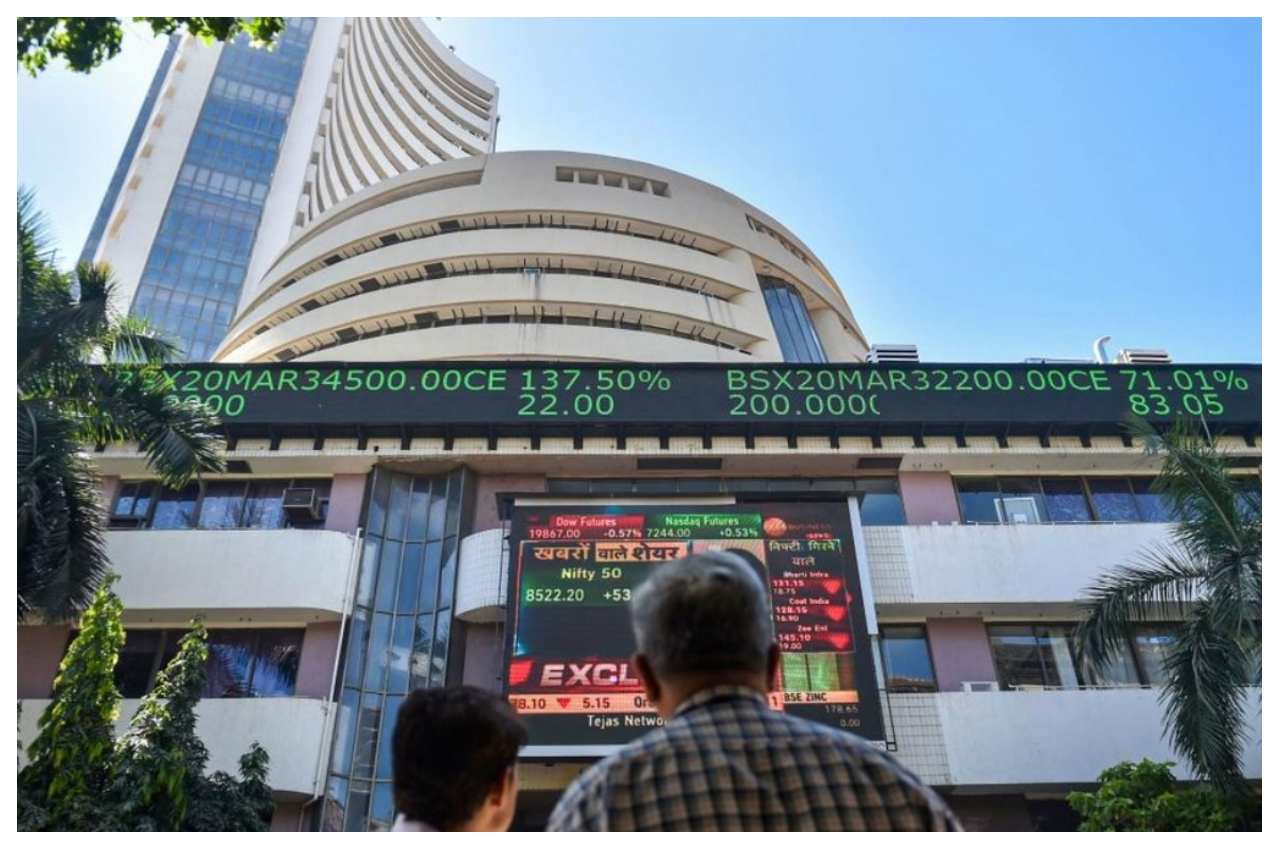

New Delhi: On Thursday, the fourth day of the trading week, the Indian stock market saw a lethargic session as investors stick to stock-specific trading strategies after the Karnataka Assembly elections continue to influence the markets.

Market indices fluctuating between gains and losses were thrashed down by a decline in Larsen & Toubro shares with weak global markets.

Nifty 50 was at 18315.10 points, performing 0.3% higher from the previous close. With this, 30-share BSE Sensex fell by 19.93 points to 61,920.27 points in early trade after it hit the crucial 62,000 mark in opening deals.

As the news came about Non-Executive Chairman A M Naik of Larsen & Toubro deciding to step down from his post, it collapsed over 5 per cent.

Technical Position

On the technical part, a long-legged doji-type candle pattern was seen on the daily chart, which was amid range movement.

What is meant by these doji patterns is that at the high post, a reasonable upside calls for a warning for bulls at the hurdles. With a pattern formed like this within a range movement, the anticipated value of it could be less, said Nagaraj Shetti, technical analyst, at HDFC Securities.

Firms like ITC, Bharti Airtel, Nestle, Tata Steel and Tata Motors are trading at a slow pace but falling behind others.

On the other hand, NTPC, Tech Mahindra, HCL Technologies, Infosys, Bajaj Finserv, Bajaj Finance, Wipro and State Bank of India trading positively

Recent updates

Among 13 major sectoral indexes, 10 of them moved forward with high weightage financials and information technology(IT) gaining 0.4% and 0.5% respectively.

Equity shares of Adani Enterprises took a high to 4.38% as the company’s board said it will think of a fundraiser.

“The main driver of the ongoing rally is the sustained FII inflows,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

Among Asian markets, Shanghai and Hong Kong markets traded at a slower pace while Seoul traded in the green.