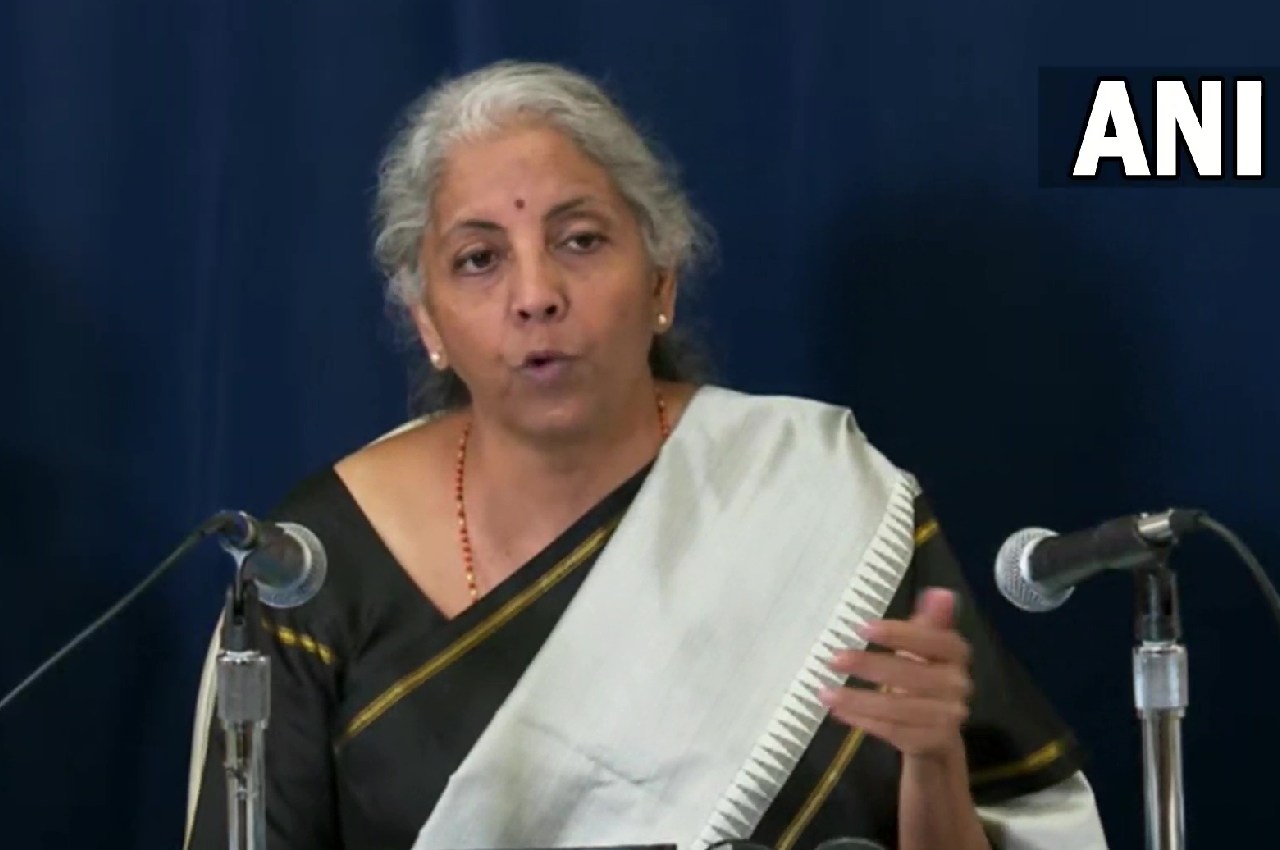

Days before Finance Minister Nirmala Sitharaman presents Union Budget 2025-26, the Indian Rupee has hit the record low and touched 86.2050 against the US Dollar on Monday. Is it just a coincidence that BSE Sensex tumbled 800 points down when the opening bell rang? How will these two factors among others impact first full Budget of Modi 3.0?

The Indian Rupee came under pressure after the US job data showed the addition of 2,86,000 new jobs last month, indicating that the Federal Reserve may hold at least for some time any decision to slash the interest rate as the unemployment rate has come down to 4.1% surprisingly.

There are other factors too like increased yield on US Treasury bills.

Will Weak Rupee Complicate Issues For Nirmala Sitharaman?

The weakness of currency indicates that the foreign reserve has come under pressure due to less-than-expected export figures. It may further complicate the problem for those industries that depend heavily on imports for capital expenditure and raw materials.

Also Read: Union Budget 2025: IMF Highlights Weak Indian Economy, Nirmala Sitharaman Prepares Bold Moves

A weak Rupee may increase the input cost for these industries.

The Union Budget 2025-26 is also coming at a time when the US-India trade ties may have a fresh start with President-elect Donald Trump having already repeatedly announced his plans of imposing puitive tariffs on goods from China, India, Canada ad Mexico.

Will Donald Trump’s Inauguration Impact Union Budget?

Trump announced on the campaign trail his decision to implement the “America First” policy and reiterated it after he got elected.

Trump will take oath as the US President on January 20, more than a week before Nirmala Sitharaman will present her budget in Lok Sabha on February 1.

Also Read: Union Budget 2025: Will Nirmala Sitharaman Simplify GST, Increase MNREGA Wages?

Earlier in 2024, the rupee declined 5 paise to hit 83.71 against the greenback after Nirmala Sitharaman raised tax rates on capital gains in the Budget.

As the currency is already under pressure, the Finance Minister will not have the leverage to take any decision that may further erode foreign reserves and push the Rupee against the US Dollar.

FIIs Sale Indian Stocks

Earlier, the FIIs sold securities worth Rs 22,259 crore in less than ten trading sessions so far this year. The net outflow of Rs 1.20 lakh crore took place last year. The weakening of the rupee has been the biggest factor, which still continues.

The further outflow of the weakening of the rupee against the dollar is not unexpected as the 2-year-US Treasury bills will soon hit the market, and the FIIs may get tempted to further offload their Indian stocks.

It is most likely to take place before February 1, when the Finance Minister will present her 8th Union Budget. Nirmala Sitharaman may come under pressure if it happens.

Also Read: Union Budget 2025: Will Nirmala Sitharaman Ease Burden On Salaried Class By Slashing Income Tax?

The imposition of tariffs on Indian goods may be another US factor impacting the Union Budget 2025-26. The bilateral trade is in favour of India with a trade surplus of $35.3 billion in 2023-24.

Trump earlier announced to imposition of punitive tariffs on Indian goods to encourage the US manufacturers under the America First policy.

Finance Minister Nirmala Sitharman will present the Union Budget 2025-26 under these constraints, among many others.

Earlier, Goldman Sachs said that the Finance Minister should strike a balance between growth and fiscal discipline considering the rising public debt and fiscal deficit.

The fiscal deficit has been rising over the years. The government earlier announced to limit the fiscal deficit to 4.9% of the GDP for FY 2024-25 and 4.5% to FY 2025-26.

With her hands tied, what actions will she take to give a fillip to the stock market, encourage capital expenditure or boost exports when the rupee will remain vulnerable?