New Delhi: To overcome the ever-increasing inflation, the Reserve Bank (RBI) has once again increased the repo rate (RBI Repo Rate Hike). RBI has now increased the repo rate by 50 basis points.

After this hike, the repo rate has increased to 5.40 percent. This is the third consecutive hike made by the RBI in the repo rate. Earlier, the RBI had increased the repo rate by 40-basis points in May and by 50 basis points in June.

The meaning of this announcement of RBI is that your EMI is going to increase significantly due to this. Its effect will be seen in the form of home loan, car loan and personal loan EMI being expensive.

Also Read :-Adani Group to acquire Macquarie Asia Infra Fund’s India Toll Roads in AP, Gujarat for Rs 3,110 Cr

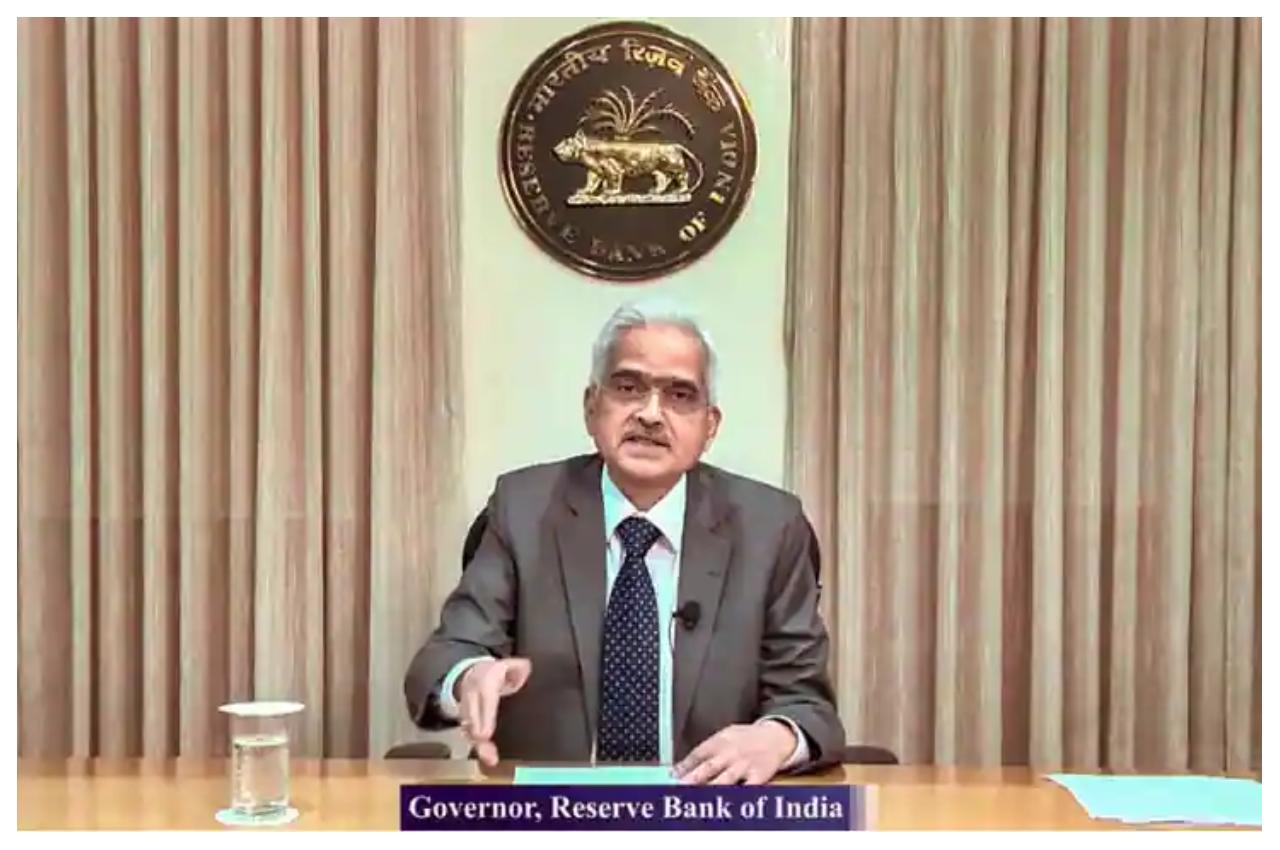

Announcing the increase in the repo rate, RBI Governor Shaktikanta Das said that at this time the pressure on globalization and global economy is clearly visible. Emerging markets are also seeing the impact of the changing scenario of the global economy.

Shaktikanta Das said that the Indian economy is also not untouched by the changing conditions of the global economy and concerns about inflation in the country remain. The effect of the change in the country’s export and import data is expected to remain within the prescribed limit of the current account deficit. He said that many institutions from IMF to IMF have predicted the rapid growth of our economy and it will grow at the fastest pace.

Also Read :-Adani Enterprises & Israel Innovation Authority sign MoU to develop cutting-edge tech solutions

What is Repo Rate and Reverse Repo Rate?

Repo rate is the rate at which loans are given to banks by RBI and banks give loans to customers from this loan. An increase in the repo rate means that many types of loans from the bank will become expensive.

Reverse repo rate is the rate at which banks get interest from RBI on deposits.

Read More :- Latest Business News

Click Here – Download The News 24 App