RBI Monetary Policy: RBI on Thursday decided to keep repo rate unchanged at 6.5%. The RBI also retained FY24 GDP growth forecast at 6.5%, while expects FY24 CPI inflation to be at 5.1%. The Reserve Bank of India (RBI) has given great relief to the common man. (RBI Monetary Policy meet)

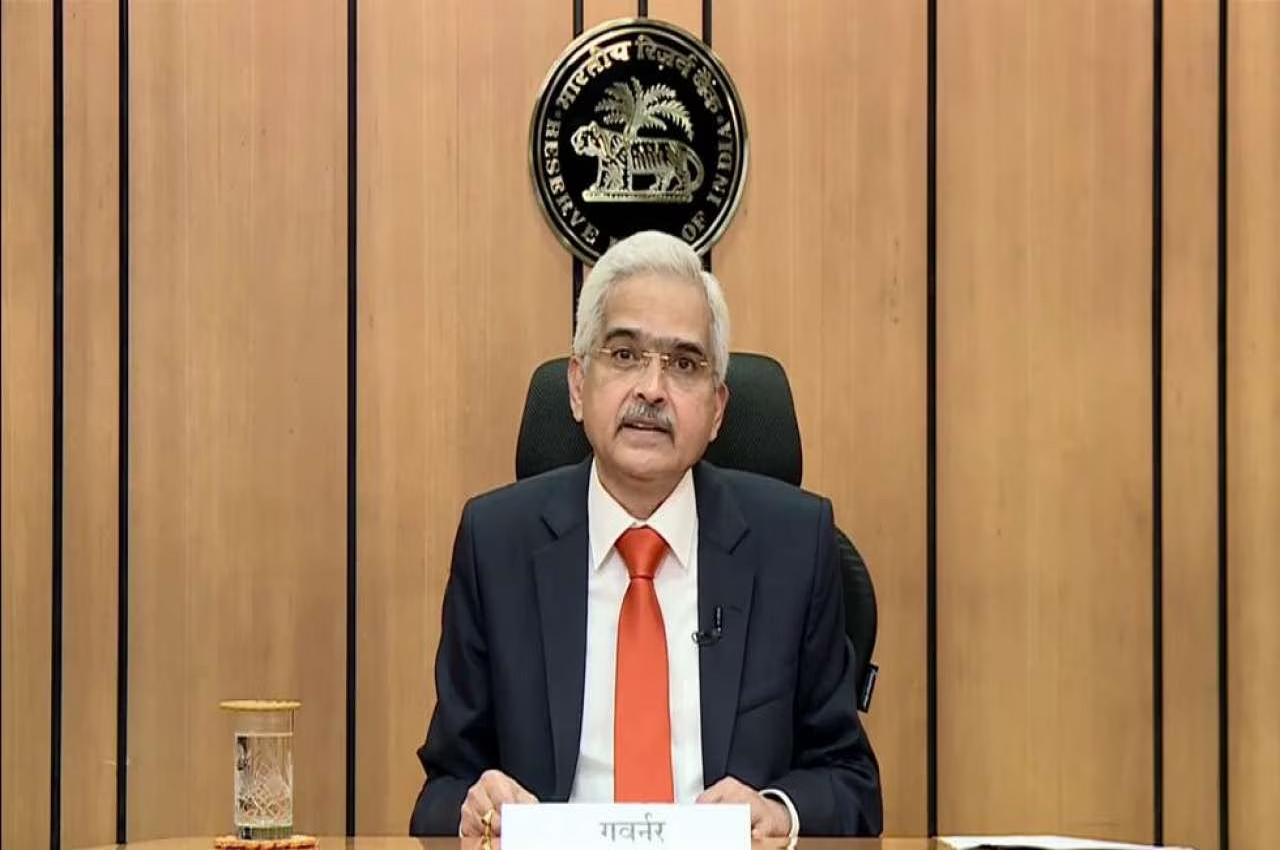

In fact, the Monetary Policy Committee (MPC) of RBI meets every two months. Today, on the third day of the RBI Monetary Policy Committee meeting, which began on June 6, RBI Governor Shaktikanta Das announced its results. He said that this time also there was no change in the repo rate. Shaktikanta Das said CPI inflation is still above our 4 per cent target and will remain above it in 2023-24 as per our forecasts.

Along with this, he said that the GDP growth estimate for the financial year 2023-24 is expected to be 6.5 percent. Along with this, he said that the SDF rate remains at 6.25 per cent and the marginal standing facility and bank rates at 6.75 per cent.

After the last meeting held in April, it was decided by the RBI not to make any change in the repo rate. The RBI governor had said that this decision has been taken to maintain the ongoing recovery in the country’s economy. However, he indicated that if the need arises, the repo rate can be increased further.