Personal loans: Personal loans in the form of loans are one of the quickest ways to arrange funds to meet unexpected financial needs such as health, wedding, travel, loan repayment, and so on. The need for funds during an emergency can be of any kind, and the funds obtained through a personal loan can be used for any purpose.

People prefer personal loans because of their quick approval and disbursement. When you apply for such a loan, the lending bank or financial institution looks over all of your information, including your income, credit score, employment status, age, and place of residence. When the relevant profile is verified as correct, the bank or financial institution deposits the personal loan amount into your account.

Applying for a personal loan has become very simple in recent years. If you prefer, you can apply offline by visiting your nearest bank or financial institution, or online by visiting the bank’s website. Because of their income and good credit, some customers are pre-approved for personal loans. Before accepting such loan offers, the terms and conditions of the personal loan must be thoroughly read.

Personal loans: Pay your loan EMI on time

Avoid using the funds obtained through a personal loan for non-essential purposes. One of the most important things is that after obtaining the loan, he should do everything in his power to repay it without delay or default. A sufficient income and funds should be set aside ahead of time to repay the personal loan. The loan term should also be carefully chosen. Personal loans typically have terms ranging from 12 to 84 months. It can, however, vary depending on the borrower’s profile and the bank or financial institution providing the loan. The loan term is sometimes extended. Keep in mind that if there is a long-term loan, more interest must be paid.

Personal loans: Income, good credit score needed

When applying for a personal loan, the borrower should consider his or her monthly income, credit score, and loan eligibility based on the loan amount required. Before borrowing, be certain of the loan amount. Once this has been confirmed, the method of repayment must be understood. Then, compare the plans for the same loan amount offered by various financial institutions. Also, look for the cheapest loan available. After that, it will be much easier to make a decision. If one bank offers a loan at.25 basis point less than another, understand that choosing that loan will save you a lot of money in interest payments.

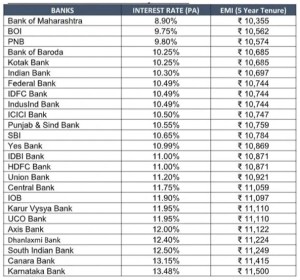

Personal loans: Banks list with lowest interest

We have provided a list of personal loans up to Rs 5 lakh offered by more than 20 banks, along with applicable interest rates and repayment terms in the form of EMIs, for your convenience (monthly instalments). The loan included in the list has a 5-year term. The cheapest personal loan is offered by Bank of Maharashtra, which is ranked first on this list. Personal loans from Canara Bank and Karnataka Bank, on the other hand, are more expensive than those from other banks. You can make the best decision for yourself by comparing this list to others.

(Note: The details of all the banks in the above given list have been taken from bankbazaar.com. All these figures have been taken from the respective bank’s website till 29 November 2022. For more information, you can visit the bank’s website.)