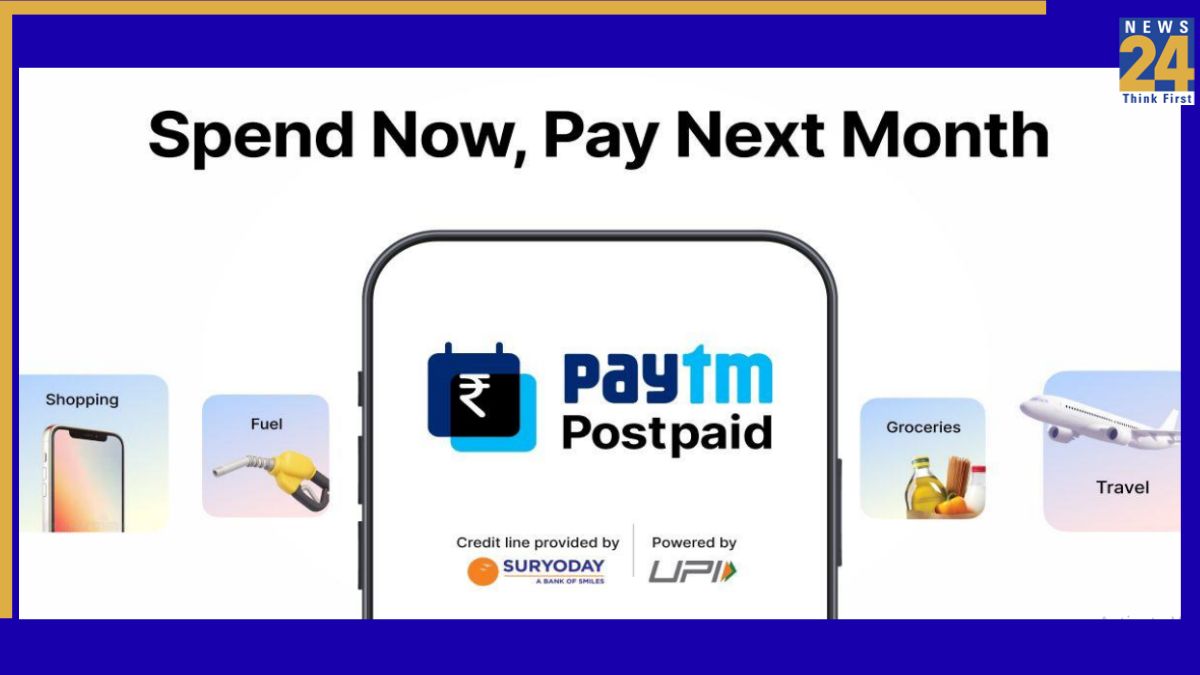

Paytm Postpaid: There is good news for Paytm users, as the company has announced a new feature set to enhance the customer experience. One 97 Communications Limited, the parent company of Paytm has launched Paytm Postpaid as credit line on UPI, powered by NPCI, in partnership with Suryodaya Small Finance Bank. This enables users to access instant short-term credit and offers the convenience of ‘Spend Now, Pay Next Month’. The feature was rolled out on Wednesday, September 17.

The‘Spend Now, Pay Next Month’ feature allows customers to make payments using a credit line on UPI across all merchant touch points. This includes scanning any UPI QR code, shopping online, or paying for recharges, bill payments, and bookings on the Paytm app.

Paytm Postpaid service offers 30 days of short-term credit, giving customers the flexibility to spend instantly and repay the following month. It is interest-free credit. This further makes everyday payments smarter, faster, and more reliable. Notably, the service is currently being rolled out to a selected base. The users are identified through spend behaviour. It will be soon expanded to more consumers.

Paytm Postpaid: How to activate?

To avail the Paytm Postpaid service, follow these steps:

Step 1: Open the Paytm app, tap the Paytm Postpaid icon on Home page.

Step 2: Create your Credit Line on UPI account by filling your basic details, validate your KYC and setting up the mandate.

Step 3: Link your account with UPI to start using the credit line.

Step 4: Choose Suryodaya Small Finance Bank and authenticate using Aadhaar.

Step 5. Set up a UPI PIN and start making payments through the linked credit facility on UPI.

In a statement released by Paytm, Avijit Jain, Chief Operating Officer, Lending, said, “In India, families and individuals often look for a little extra flexibility to manage their everyday expenses with ease. We are delighted to bring Paytm Postpaid, Credit Line on UPI, which makes it possible to spend instantly and comfortably repay the next month. Whether it’s paying at a local store, managing household bills, or shopping online, this solution is designed to make life simpler. In partnership with Suryodaya Small Finance Bank and powered by NPCI, this launch reflects our commitment to offering secure, compliant, and innovative payment solutions that truly put consumers first.”