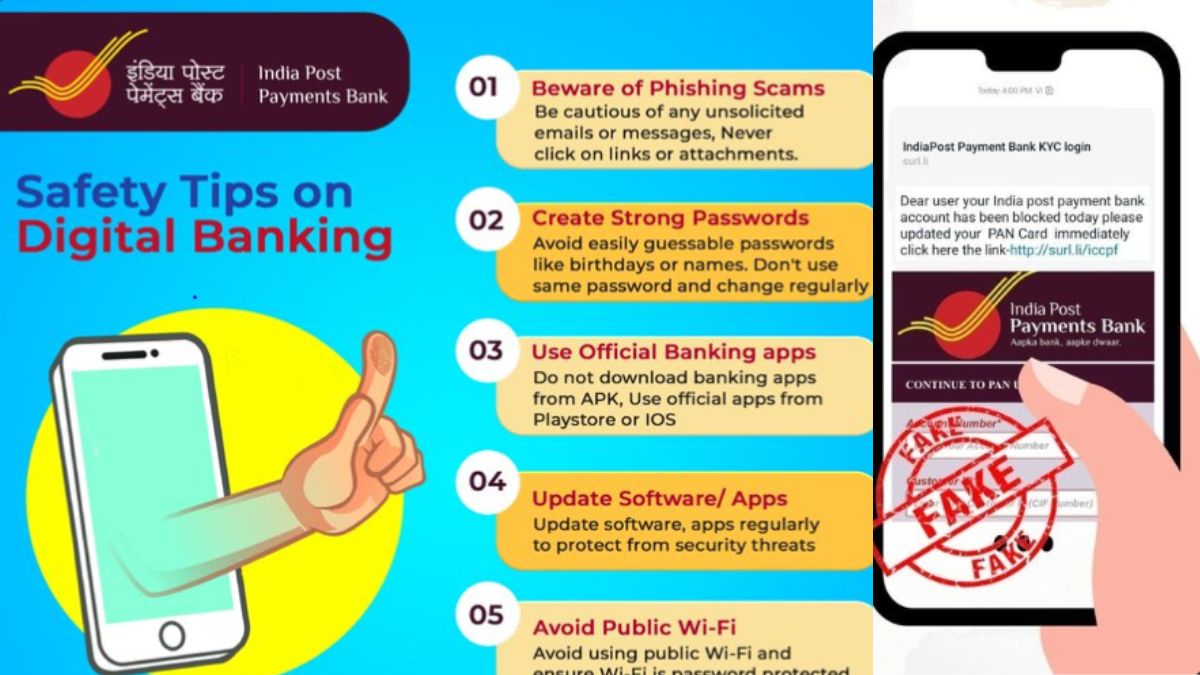

A new digital scam has come to light after India Post Payments Bank (IPPB) customers reportedly complained about receiving messages claiming their bank accounts had been blocked for not updating their PAN card details. Further investigation revealed that these messages also contained a link prompting users to update their PAN information. The Press Information Bureau’s (PIB) Fact Check team has confirmed that these messages are fraudulent and clarified that India Post does not send such notifications. India Post has urged the public not to click on suspicious links or share any personal information.

PIB Fact Check

Scammer Claim: Your bank account has been blocked for not updating PAN card details.

Truth: India Post has clarified that it does not send such alerts and warns customers not to click on any suspicious links.

Claim: The customer's India Post Payments bank account will be blocked within 24 hours if their Pan card is not updated. #PIBFactCheck:

❌ This claim is #Fake

➡️ @IndiaPostOffice never sends any such messages

➡️ Never share your personal & bank details with anyone pic.twitter.com/B7CEdp0g2f

— PIB Fact Check (@PIBFactCheck) January 4, 2025

In a post on social media platform X, PIB clarified, “The claim that IPPB accounts will be blocked within 24 hours if PAN details are not updated is false. India Post never sends such messages.”

How Scammers Target People

This scam is a classic example of phishing—a type of cyber fraud where scammers trick people into sharing sensitive details like passwords, PINs, or account information. In this case, they play on people’s fears by sending fake warnings about account blocks. These messages often include fraudulent links, and clicking on them could expose your personal and financial data to theft.

Tips To Stay Safe

India Post Payments Bank (IPPB) is urging its customers to adopt safe digital banking habits to keep their financial information secure. They recommend regularly updating passwords and steering clear of fake customer care numbers. Customers should also keep a close eye on their account activity to spot any unauthorized transactions and avoid clicking on suspicious links. Additionally, IPPB warns about the dangers of using public Wi-Fi for banking and emphasizes the need to verify any communication claiming to be from the bank before taking action.

Keep your finances secure with safe digital banking practices! Regularly update passwords, avoid fake customer care numbers, monitor your accounts, and avoid suspicious links. Be cautious with public Wi-Fi, and always verify the authenticity of banking communications. Your… pic.twitter.com/nGBA9xvMHz

— India Post Payments Bank (@IPPBOnline) December 31, 2024

How Can Customers Stay Safe From The Phishing Scams?

When you receive messages, always be cautious, especially if they create a sense of urgency. Think twice before sharing sensitive details like your PAN, Aadhaar, or bank information on unsecured platforms. Keep yourself informed about different types of online scams and learn how to spot fraudulent schemes. Make it a habit to check your bank account for unauthorized transactions, and if you notice anything suspicious, report it to your bank right away. Staying alert can go a long way in protecting your finances.

Enable Two-Factor Authentication (2FA): Enable two-factor authentication (2FA) for extra security. With 2FA, you’ll need to complete an additional verification step—like entering a code sent to your phone—before accessing your account. This added layer of protection makes it much harder for hackers to get in, even if they somehow get hold of your password.