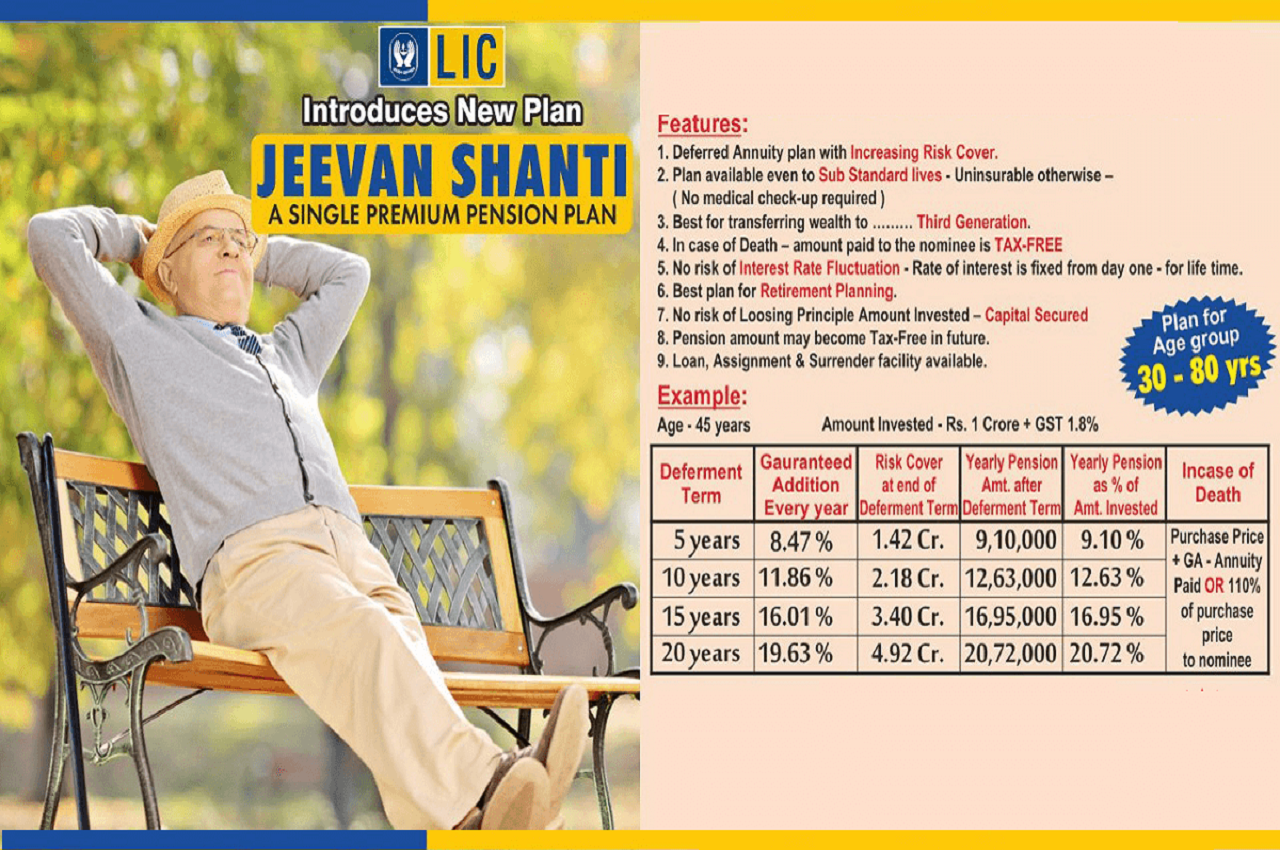

LIC New Jeevan Shanti Plan: Life Insurance Corporation of India (LIC) is one of India’s most trusted companies, offering a wide range of insurance to its consumers. The New Jeevan Shanti (Plan No. 858) was recently upgraded by LIC, and it now offers a better annuity rate and enhanced purchase-price-based incentives.

The LIC’s New Jeevan Shanti is an excellent alternative for anyone looking to retire early with a fixed monthly, quarterly, semi-annual, or annual cash flow. One must pay a purchase price and wait for the deferment time to expire (from 1 to 12 years).

Read More :-LIC WHATSAPP SERVICE LAUNCHED FOR POLICY HOLDERS; NOW GET YOUR ALL LIC WORK DONE AT HOME

The plan has no maximum purchase price limit, therefore the more the purchase price, the greater the annuity obtained by the consumers. The LIC website has a calculator that may be used to estimate the annuity that can be obtained by paying a given purchase price.

How much you need to spend for a Rs 1 lakh and Rs 50,000 monthly pension.

The LIC’s New Jeevan Shaanti Plan provides a monthly pension of Rs 1 lakh.

When the deferment time is 12 years, a purchase price of Rs 1 crore results in a monthly pension of Rs 1.06 lakh, according to the LIC calculator. The monthly pension will be reduced to Rs 94,840 if the delay period is 10 years.

LIC’s New Jeevan Shaanti Plan provides a monthly pension of Rs 50,000.

When the deferment term is 12 years, a purchase price of Rs 50 lakh will result in a monthly pension of Rs 53,460.

Read More :-LINK YOUR AADHAR CARD TO PAN CARD BEFORE IT’S TOO LATE; LINKING DETAILS HERE

The monthly pension will be reduced to Rs 47,420 if the delay period is 10 years.

The calculator can also be accessed via the LIC website to determine how much pension you can receive in certain scenarios.

Read More :- Latest Education News