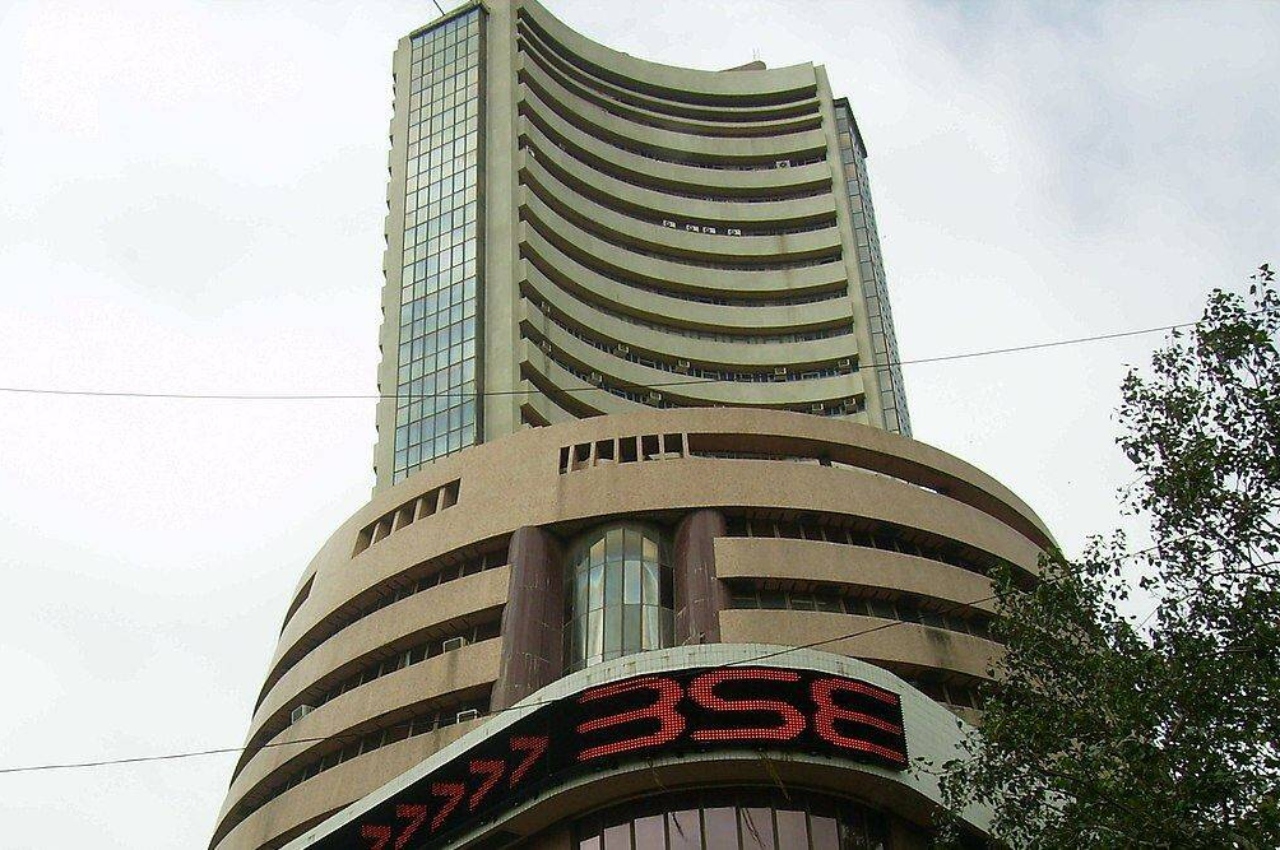

New Delhi: Due to the fag-end selling that sent the benchmarks considerably lower on Tuesday, domestic index shares experienced yet another day of disappointment as they extended their loss streak to three straight sessions. At 57,147, the BSE Sensex finished down 844 points. Nifty50, its larger counterpart, finished at 16,983, down 257 points.

The market capitalization of all BSE-listed companies fell to Rs 270 lakh crore, making Dalal Street investors poorer by Rs 4.3 lakh crore.

Foreign institutional investors, or FIIs, have changed from buyers to sellers in the market due to macroeconomic concerns. FIIs have sold Indian stocks worth over Rs 7,600 crore, totaling roughly Rs 1,500 crore in net sales so far this month. The sell-off from yesterday totaled Rs 2,139 crore.

“India’s outperformance to date made a case for profit booking for the FIIs today as geopolitical and currency risks came to the forefront,” said S Ranganathan, Head of Research at LKP Securities.

Asian shares were mostly weaker on Tuesday as concerns over the US Fed’s aggressive rate hikes increased. South Korea’s Kospi fell 1.83%, Hong Kong’s Hang Seng fell 2.2%, and Japan’s Nikkei225 finished 2.64% worse.

As the blue-chip FTSE 100 dropped 1.1%, marking its fifth straight day of losses, the mood was also gloomy on the European stock markets.

The 10-year U.S. Treasury note yield hit 3.99% earlier in the day on speculation that the Fed might choose to implement a further 75 basis point raise in the first few weeks of November in an effort to battle inflation following a positive jobs report.

Despite support from the RBI, the Indian rupee rose 5 paise today to close at 82.35 against the US dollar, but the domestic currency’s deterioration has been harming stocks. The rupee has currently lost 11% of its value against the dollar. Today, the US dollar index was higher than 113.

When he predicted a recession will occur over the next 6 to 9 months, Jamie Dimon, CEO of JP Morgan, added to the market’s pessimism.