New Delhi: Two sessions of falling stock prices have reduced investor worth by more over Rs 6.57 trillion.

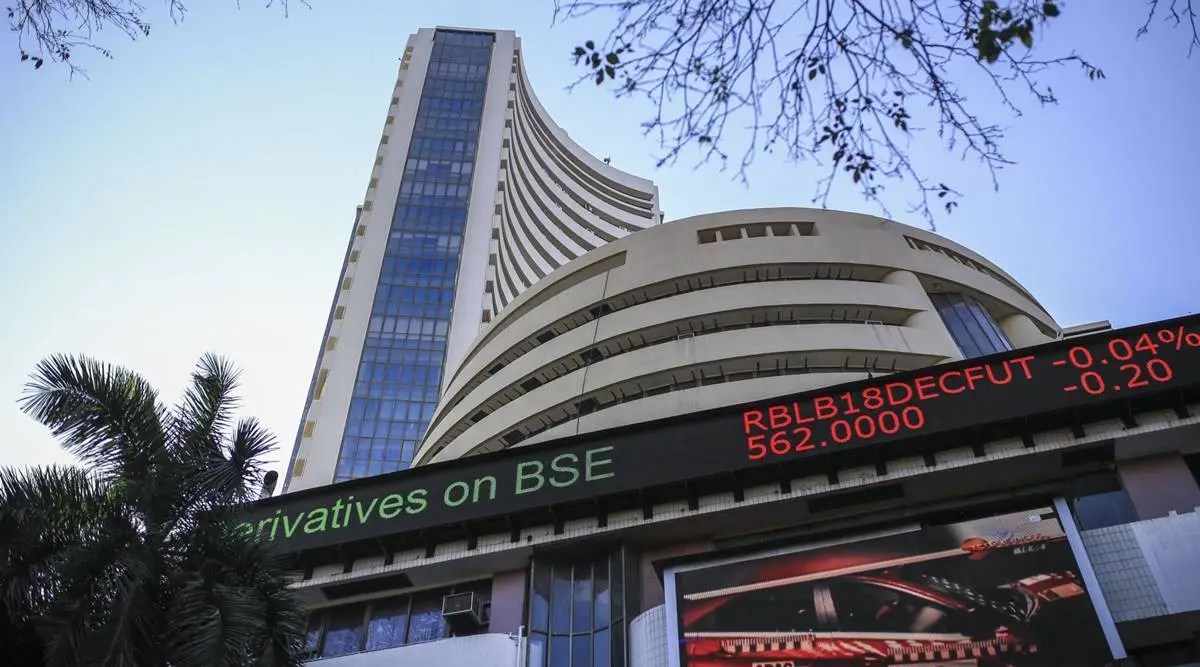

The 30-share BSE Sensex fell 872.28 points or 1.46 percent on Monday, ending the day at 58,773.87 points.

The benchmark index has lost 1,524.13 points, or 2.52%, in two straight days.

Also Read :- Executives of Apple, Google, Netflix, Amazon India to appear before parliamentary panel

The market capitalization of companies listed on the BSE fell by Rs 6,57,758.04 crore to Rs 2,73,95,002.87 crore (about Rs 273.95 lakh crore) in just two days due to the general market’s negative trend.

“While correction was overdue for sometime after the recent upsurge, fresh concerns of a likely hawkish stance by the US Fed in its September meet and strengthening dollar index turned investors jittery and triggered a massive fall in banking, IT, metal and realty stocks,” Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities Ltd, said.

Analysts claim that recent worries about the expansion of the world economy have impacted market mood.

“Negative global cues weighed on indices at the Dalal Street as Nifty ended below the psychological 17,500-mark and Sensex too fell way below its recently reclaimed psychological 60,000-mark.

“Blame the negativity to last week’s Fed meeting minutes which pointed towards more aggressive rate hikes to curb inflation. If the last two days’ trade is any indication, then expect investors to stay on the sidelines in the coming session,” Prashanth Tapse – Research Analyst, Senior VP (Research) at Mehta Equities Ltd, said.

Tata Steel, which fell 4.50 percent on Monday, was the biggest loser in the Sensex pack, followed by Asian Paints, Wipro, Sun Pharma, Larsen & Toubro, Bajaj Finance, UltraTech Cement, and Bajaj Finserv.

ITC and Nestle India had better results.

Also Read :- Paying in cash in THESE places may land in trouble, know why

All BSE sectoral indices ended lower, with metal down 2.69 percent, real estate down 2.47 percent, basic materials down 2.44 percent, consumer durables up 2.01 percent, finance down 1.88 percent, and banks down 1.8 percent (1.88 per cent).

The BSE midcap gauge and smallcap index both had declines in the broader market of 1.80% and 1.170%, respectively.

“Consolidation was triggered in the market in anticipation of tighter monetary policy by the Fed and worries over a slowdown in global economic activity,” Vinod Nair, Head of Research at Geojit Financial Services, said.

Read More :- Latest Business News

Click Here – Download The News 24 App