The Centre is likely to announce big-ticket measures in the July 23 Union Budget for offering social security benefits to gig workers, who are primarily engaged with e-commerce companies, manufacturing, and construction. She is likely to come out with a social security fund where contributions would be made by employees, contributing companies, and also the government, the Finance Minister, Nirmala Sitharaman. This fund will be used to extend accident and health insurance coverage to gig workers.

Sources said that the government may announce a National Social Security Board in the next Union Budget for the unorganized sectors and all the gig workers which shall give them benefit from medical treatment to their families on the lines of ESIC. The budget may also announce the retirement benefits and other facilities from this fund for the temporary employees. It is incidental that the proposed Social Security Code-2020 also provides for such provisions. Recently, a draft bill for gig workers was introduced in Karnataka, involving a host of provisions aimed at protecting the interests of temporary employees.

Government Plan for Gig Workers’ Social Security Benefits

As per the plan prepared by the government, all gig workers will have to be compulsorily registered for extending social security benefits. The companies hiring them would be held responsible for the same. Moreover, companies might be asked to contribute 1-2% of their revenues towards this social security fund. Companies engaged in construction-related works might also be asked to bear the burden of SEIS recovery for the social security fund. Even fines realized from companies violating these rules would be deposited in the social security fund.

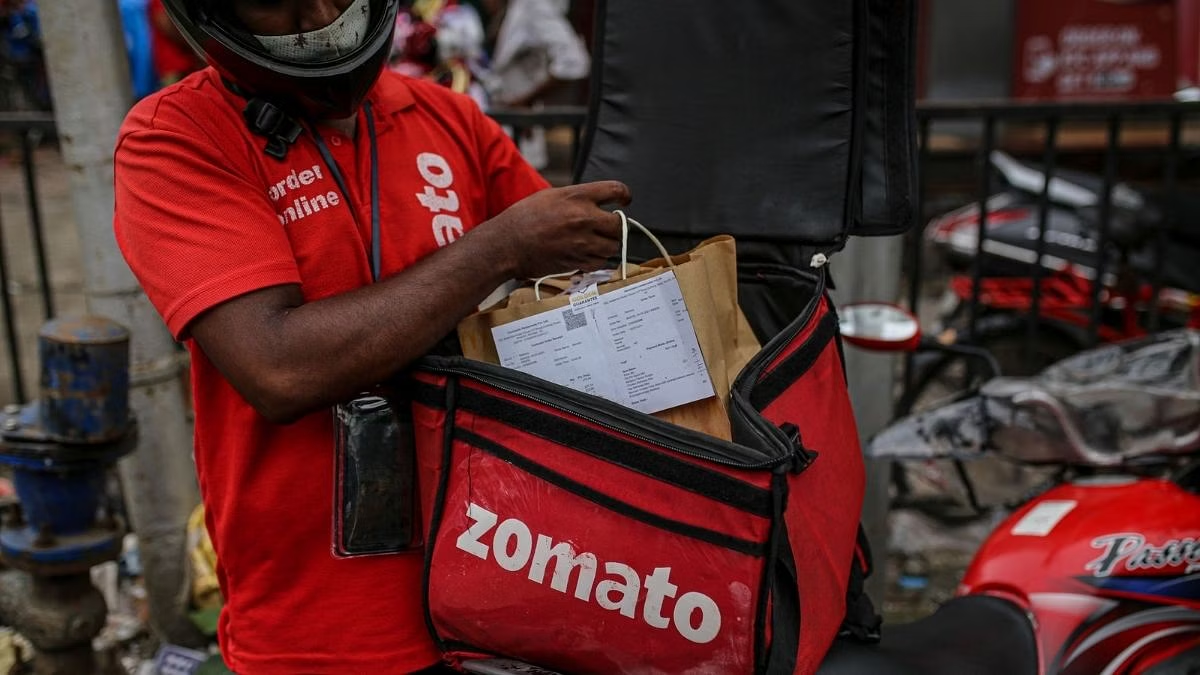

Gig workers are those workers who are engaged with different sectors as per the requirement. To be more elaborative, these are the employees working on contracts in factories, employees on contracts with online platforms, employees of contracting firms, employees working on an IT company’s contract or project basis, and employees available for call-based work, and so on.

Also Read: CSK-Linked Telecom Tycoon’s Son Ajahn Siripanyo Chooses Monkhood Over ₹40,000 Crore Inheritance

Enhancing Insurance Claim Efficiency

With an eye toward streamlining a sometimes process of submitting health insurance claims, 33 of the nation’s largest health insurance companies are combining to form the National Health Insurance Claims Exchange. The goal is to trim the time it takes to process insurance claims and provide real-time claim information to patients.

National Claims Information Hub

The government established the National Health Insurance Claims Exchange, whose objective is information sharing on claims. Previously, insurance companies used to share information regarding claims from varied platforms. Now, there will be all the information on one platform. All this information is at the public’s disposal and hence they can check on the status of their insurance claims on their mobile phones at any time. With this exchange, it helps avoid discrepancies like rejecting valid insurance claims.