In 2021, the Indian government launched the BH series number plate, also known as the India series registration numbers, for non-transport vehicles across the country. This move aimed to simplify the process for professionals moving between states or union territories, avoiding the requirement for vehicle re-registration. While BH series number plates provide various advantages, they are subject to specific eligibility criteria and regulations.

Eligibility for BH Series Number Plates

Access to BH series number plate is restricted. They are reserved for active Indian citizens in central or state government roles, banking, defense, administrative services, etc. Private sector employees can obtain them if their company operates offices in at least four states or union territories.

As per the Ministry of Road Transport and Highways, the BH series offers vehicle registration options to armed forces personnel, central/state government employees, public sector undertakings, and private sector employees with offices in four or more states/union territories.

Also Read: Before Purchasing Hyundai Verna, Consider The Rival Car With 1.45 Lakhs Discount!

How to Applying for BH Series Number Plates

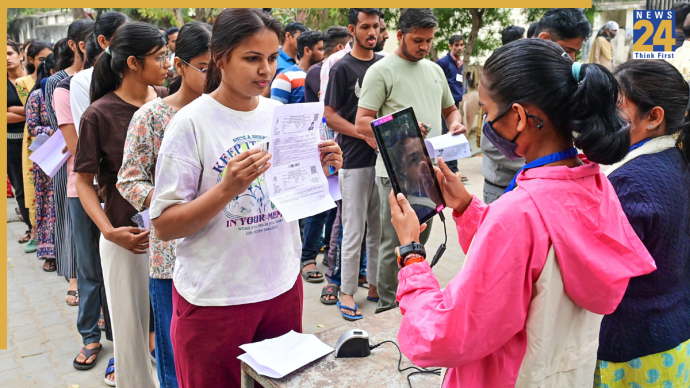

When purchasing a new vehicle, owners need to complete Form 60 to apply for a BH series number plate. They must also submit valid proof of employment and identification online. These documents will be verified by government officials before issuing the BH series registration.

Cost and Duration of BH Series Number Plates

Vehicles with BH series number plate will incur motor vehicle tax every two years or its multiples for 14 years. After 14 years, the vehicle tax is halved compared to previous charges.

It’s important to note that vehicles with BH series number plate can be sold or transferred to anyone, regardless of eligibility for the BH series. When buying or selling a vehicle with a BH series, the new owner must re-register it with the local RTO to obtain a regional registration number. Additionally, the new owner must pay registration fees and taxes as per state or centrally-governed territory regulations.

Also Read:Audi Unveils Budget-Friendly Model With Advanced Features And 241 kmph Top Speed

Unique Features of BH Series Number Plates

Each digit or letter on the BH series number plate has significance. The first two digits indicate the registration year, followed by BH representing India. The next four digits are assigned randomly by a computer, and the final English alphabet character is also randomly assigned, excluding ‘I’ and ‘O’.