GST Council Meeting: The Goods and Services Tax (GST) Council at its 50th meeting on Tuesday agreed to the recommendation of the fitment committee to levy a 22 per cent compensation cess for Multi Utility Vehicles (MUV) across the country. However, Sedan has not been included in the list.

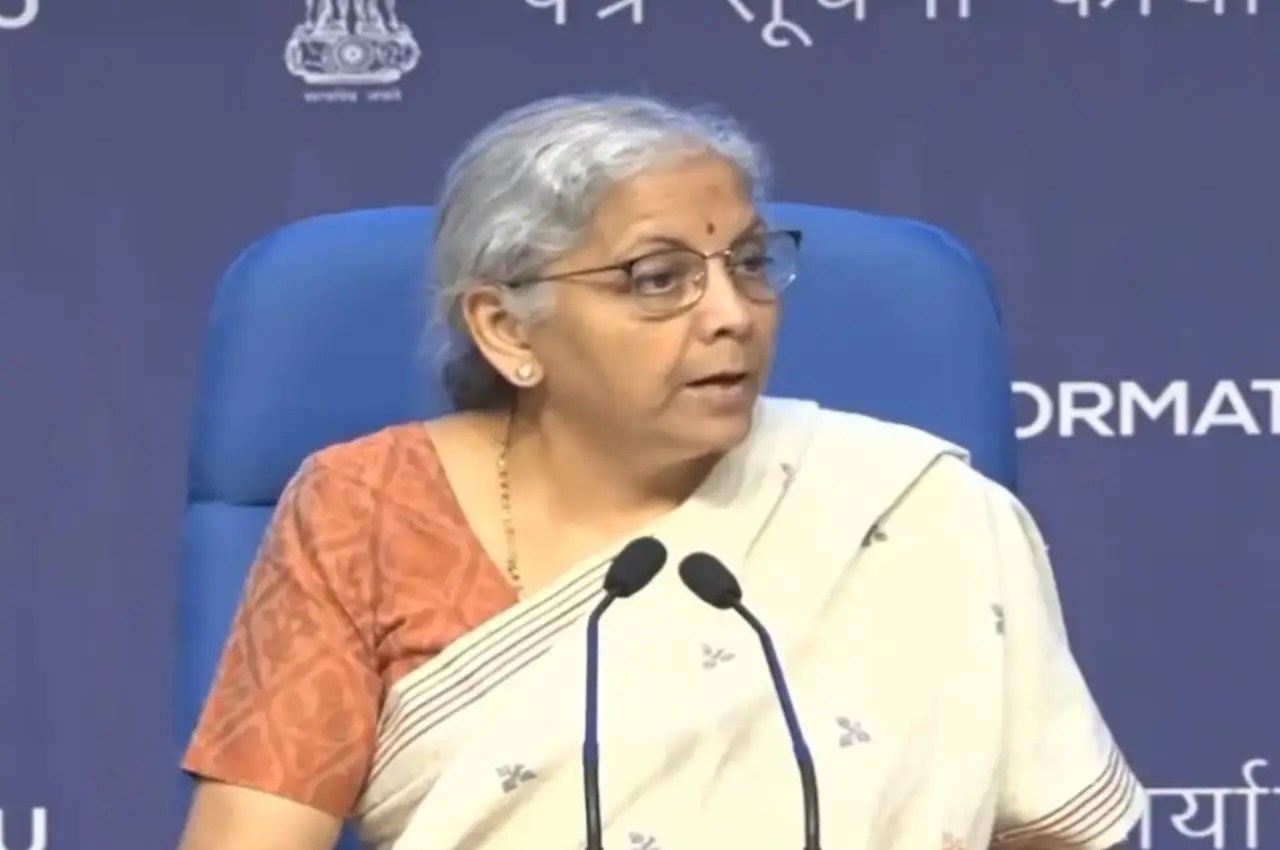

Addressing the Media, Finance Minister, Nirmala Sitharaman said, “GST Council also decided on the definition of utility vehicles and tightening of norms for registration. A clarity on taxation of Multi Utility Vehicles (MUV) was provided.”

Read More: Tata Altroz CNG’s solid quality, stylish look gives harrowing experience to Maruti Baleno

“The Council has agreed to the recommendation to levy a 22 per cent compensation cess for MUV, but Sedan has not been included in the list,” said Sitharaman adding that the two states – Punjab and Tamil Nadu were against sedans being included in the list which will see a rise in GST being taxed.

The fitment committee, consisting of tax officers from both the Centre and the states, has proposed a 22 percent cess for all utility vehicles that meet specific criteria. These criteria include a length greater than 4 meters, an engine capacity exceeding 1,500 cc, and a ground clearance of more than 170 mm in an unladen condition. It is important to note that currently, all SUVs and Multi Utility Vehicles (MUVs) fall under the 28% GST slab rate.

This recommendation aligns with the decision made by the GST Council during its 21st meeting in September 2017, where a 22% compensation cess was implemented for Sports Utility Vehicles (SUVs). Additionally, the committee observed that there are other utility vehicles that meet the length requirement of over 4,000 mm but are commonly referred to as MUVs, multipurpose vehicles, or Crossover Utility Vehicles (XUVs).